Books on Investing

If anyone wants to be a successful Investor by picking up outstanding businesses (stocks) and taking full control over their portfolio and is willing to spend time to do a thorough analysis of companies then we recommend reading the following books.

The Intelligent Investor

The Intelligent Investor by Benjamin Graham is a classic investment book that emphasizes the principles of value investing and long-term investment strategies. The book stresses the importance of fundamental analysis, risk management, and patience for successful investing. This book aims to help people invest in the stock market while minimizing their economic risks. It focuses on longer-term and more risk-averse approaches. Graham focuses on investments (based on research) rather than speculations (based on predictions). The Intelligent Investor provides guidance on how to get involved in value investing and how you can prevent Mr. Market from dictating your financial decisions.

Common Stocks and Uncommon Profits

Common Stocks and Uncommon Profits is a book written by Philip Fisher, a renowned investor and pioneer of growth investing. The book provides a detailed analysis of the investment process, with a focus on finding high-quality growth companies that have long-term potential. It outlines various investment strategies, including the use of scuttlebutt, which involves gathering information about a company from a variety of sources to gain a deeper understanding of its business and growth prospects. The book is widely regarded as a classic in the field of investment and is a must-read for anyone interested in growth investing.

The Most Important Thing

The Most Important Thing is a book written by Howard Marks, a successful investor, and founder of Oaktree Capital Management. The book offers insights and wisdom on investing, focusing on the principles of risk management, contrarian thinking, and the importance of being patient and disciplined. Marks emphasizes the need for investors to think independently and avoid herd mentality, as well as the importance of understanding cycles and market trends.

Learn To Earn

Learn To Earn: A Beginner's Guide To The Basics Of Investing And Business is a book co-authored by Peter Lynch and John Rothchild that aims to educate beginners on the basics of investing and business. The book covers topics such as the stock market, financial statements, business economics, and industry analysis. It also provides practical advice on how to develop an investment strategy and how to approach different types of investments, such as stocks, bonds, and mutual funds. The book is written in a clear and engaging style, making it accessible to readers with little or no prior knowledge of investing. It is an excellent resource for anyone looking to get started with investing and to develop a solid understanding of the principles of investing and business.

100 Baggers

100 Baggers: Stocks That Return 100-To-1 and How to Find Them is a book written by Christopher W. Mayer, a successful investor, and editor of the Bonner Private Portfolio. The book provides insights and advice on how to identify stocks that have the potential to return 100 times their initial investment. Mayer emphasizes the importance of investing in companies with strong fundamentals, a competitive advantage, and a clear path to growth, as well as the need for patience and a long-term investment horizon.

One Up On Wall Street

One Up On Wall Street by Peter Lynch is the amateur guide to investing in the stock market successfully. From why professional investors fall short when picking stocks, to how to identify great investment prospects, Peter shares simple yet effective advice for achieving financial success. This book talks about the challenges of being a stock market investor, while also exploring how anyone can pick good, well-performing stocks without having much knowledge in the field, by following a few key practices. According to Lynch, investment opportunities are everywhere. From the supermarket to the workplace, we encounter products and services all day long. By paying attention to the best ones, we can find companies in which to invest before professional analysts discover them. When investors get in early, they can find the “ten baggers,” the stocks that appreciate tenfold from the initial investment. A few tenbaggers will turn an average stock portfolio into a star performer.

Beating the Street

Beating the Street is a book written by Peter Lynch, a successful investor and former manager of the Fidelity Magellan Fund. The book provides insights and advice on how to identify profitable investment opportunities, particularly in the stock market. Lynch emphasizes the importance of doing thorough research and analysis, as well as the need to stay disciplined and focused on long-term goals. The book is a valuable resource for anyone looking to improve their investing skills and achieve success in the stock market.

Charlie Munger: The Complete Investor

Charlie Munger: The Complete Investor is a book written by Tren Griffin, a writer and investor who has studied the investment strategies of Warren Buffett and Charlie Munger. The book provides insights into Munger's approach to investing, emphasizing the importance of rational thinking, patience, and a long-term investment horizon. Griffin highlights Munger's emphasis on finding high-quality companies with a competitive advantage, and his focus on investing in businesses with simple, understandable models. The book also explores Munger's approach to risk management and the importance of avoiding costly mistakes.

Poor Charlie's Almanack

Poor Charlie's Almanack: The Wit and Wisdom of Charles T. Munger is a book compiled by Peter D. Kaufman, featuring speeches, essays, and other writings of Charlie Munger, the long-time business partner of Warren Buffett. The book provides insights into Munger's philosophy on business, investing, and life in general, highlighting his emphasis on rational thinking, lifelong learning, and ethical behavior. The book also covers Munger's approach to decision-making and the importance of understanding a variety of disciplines, including psychology, history, and economics.

Warren Buffett and the Interpretation of Financial Statements

Warren Buffett and the Interpretation of Financial Statements is a book written by Mary Buffett and David Clark, which explains how to interpret financial statements to identify profitable investment opportunities. The book focuses on the key financial metrics used by Warren Buffett, the legendary investor, and CEO of Berkshire Hathaway, and provides insights into his investment approach. The book covers topics such as balance sheets, income statements, cash flow statements, and various financial ratios. It also provides practical examples and case studies to help readers apply the concepts in real-life situations. The book is a valuable resource for anyone looking to improve their understanding of financial statements and make informed investment decisions.

The Essays of Warren Buffett

The Essays of Warren Buffett: Lessons for Corporate America is a book edited by Lawrence A. Cunningham that compiles Warren Buffett's annual letters to shareholders of Berkshire Hathaway. The book offers insights into Buffett's investment philosophy and provides guidance on investing and managing a business. The essays cover topics such as value investing, corporate governance, financial reporting, and risk management. The book also includes commentary and analysis by Cunningham, providing additional context and understanding of Buffett's ideas.

The Warren Buffett Way

The Warren Buffett Way: Investment Strategies of the World's Greatest Investor is a book written by Robert G. Hagstrom that explains the investment strategies and philosophy of Warren Buffett. The book covers topics such as value investing, moats, financial analysis, and portfolio management. Hagstrom also provides insights into Buffett's personal and professional life, which help readers understand his investment approach. The book includes practical examples and case studies to illustrate Buffett's principles and provides valuable lessons for investors of all levels.

Howard Marks Memos

Howard Marks is the co-founder and co-chairman of Oaktree Capital Management, and he is known for his insightful memos on investing and the economy. His memos cover a wide range of topics, including market trends, risk management, investment philosophy, and economic outlook. He provides practical advice and guidance for investors, drawing on his extensive experience in the industry. Marks' memos are highly regarded by investors and industry professionals, and they offer a unique perspective on the markets and investing. The memos are available on Oaktree's website and are a valuable resource for anyone looking to improve their understanding of investing and the economy.

Unlock the power of compounding

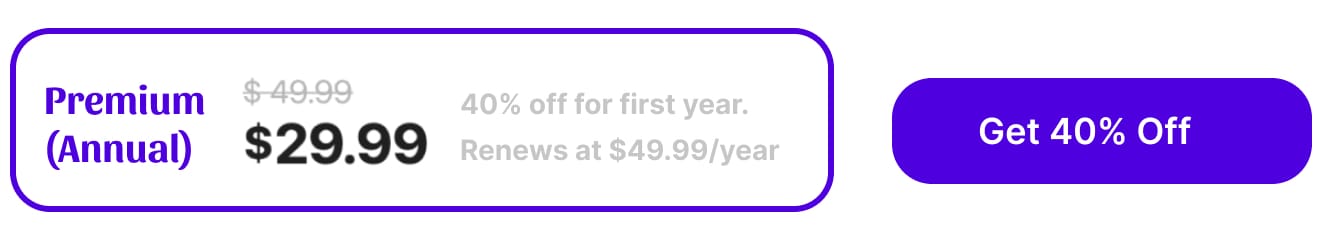

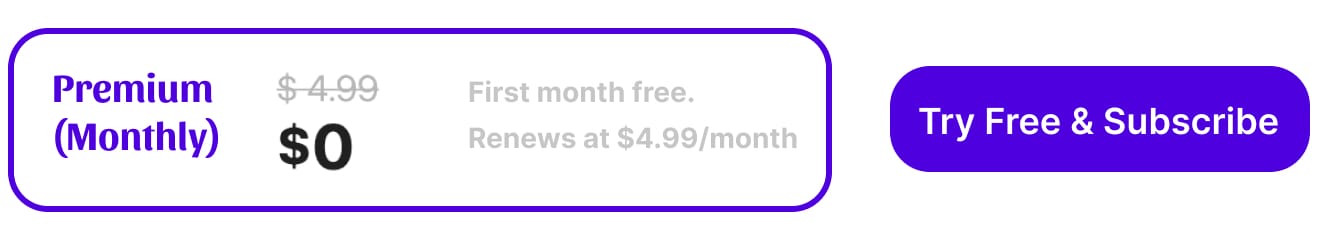

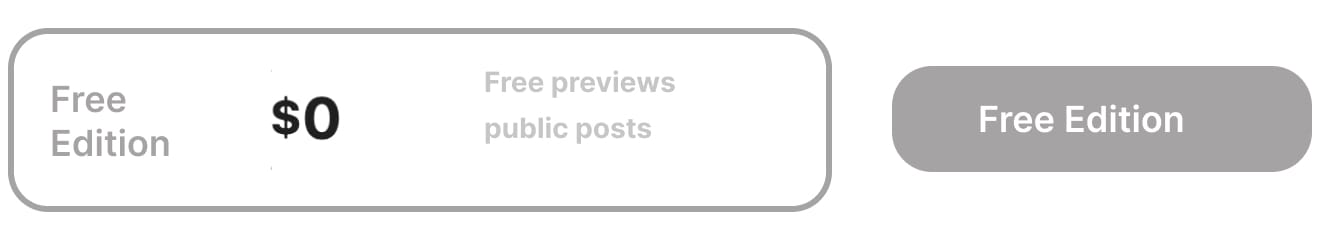

We are changing the way that people build wealth. If your portfolio is performing below S&P 500 in the last 5 years, then you need to subscribe here. Discover remarkable stories directly to your inbox. As a subscriber, you'll receive the valuable recommendation of an exceptionally outstanding company that are designed to help you build wealth.

Gain access to exclusive benefits by subscribing today!

Disclaimer: Please note that this newsletter is a financial information publisher and not an

investment advisor. Subscribers should not view this newsletter as offering personalized legal or investment

counseling. Investors should consult with their investment advisor and review the prospectus or financial / stock

recommendation of the issuer in question before making any investment decisions. All articles, blogs, comments,

emails, and chatroom contributions - even those including the word "recommendation" - should never be construed as

official business recommendations or advice. Liability of all investment decisions resides with the individual

investor.

Snowball Investing does not provide any guarantees, warranties, or representations, whether explicitly or

implicitly, regarding the accuracy, reliability, completeness, or reasonableness of the information presented. The

opinions, assumptions, and estimates expressed represent the author's viewpoints as of the publication date and are

subject to modification without prior notification. Projections made within the document are based on various market

condition assumptions, and there is no assurance that the anticipated results will be attained. Snowball Investing

disclaims any responsibility for losses incurred due to reliance on this document's content. It is important to note

that Snowball Investing is not offering financial, legal, accounting, tax, or other professional advice, nor is it

assuming a fiduciary role.

Member discussion