Investment Thesis: Costco

This is our first idea, we think this exceptionally outstanding business is a good place to start our journey. We believe that it is an excellent choice for a long-term investment that can yield satisfactory returns. This recommendation is just a start, the next step is to do your due diligence process which will then help you to make the investment decision. We strongly advise investors to do a thorough analysis of the recommendation and understand the soundness of the business before investing in this company. Also, please consult your investment advisor before making a decision.

Business Profile (NASDAQ: COST)

Costco Wholesale Corp. engages in the operation of membership warehouses through wholly owned subsidiaries. It operates through United States, Canada, and Other International Operations. The company was founded by James D. Sinegal and Jeffrey H. Brotman in 1983 and is headquartered in Issaquah, WA.

Story

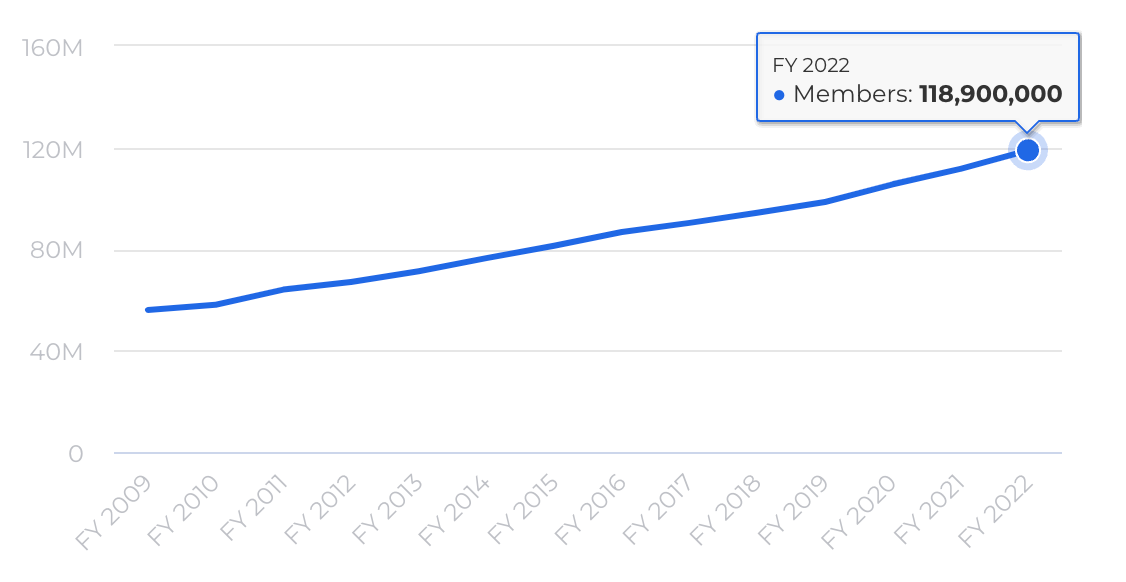

Costco is a membership-only warehouse club that has become one of the largest retailers in the world. With a focus on offering high-quality products at low prices, Costco has developed a large and loyal membership base that drives its growth. The company operates over 800 warehouses in 12 countries, serving over 110 million members worldwide.

Costco's business model is simple yet effective. The company buys products in bulk directly from manufacturers and distributors, enabling it to offer goods at lower prices than traditional retailers. The membership fees paid by customers provide a significant portion of the company's revenue, while the company also earns from the sale of products.

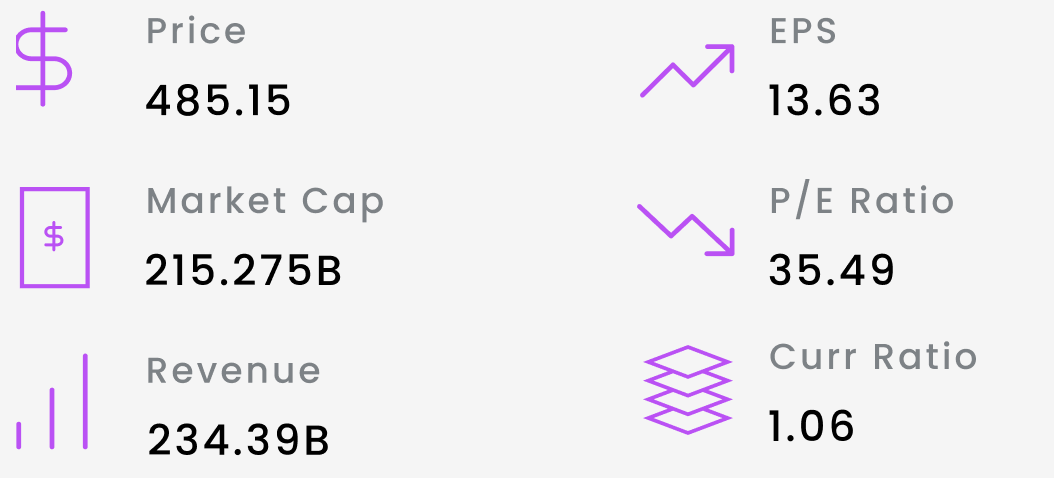

Today, Costco is widely regarded as one of the most successful retailers in the world, with a market capitalization of over $200 billion. Its warehouse clubs offer a wide selection of products, excellent customer service, and unbeatable prices.

One key factor that sets Costco apart from its competitors is its focus on efficiency. By streamlining its operations and minimizing waste, Costco is able to offer lower prices to its members while still maintaining high-quality standards.

Another factor that has contributed to Costco's success is its membership model. By requiring customers to pay an annual membership fee, Costco is able to build a loyal customer base that is willing to pay upfront for access to its low prices and high-quality products.

In addition to its warehouse clubs, Costco has also developed a strong e-commerce presence in recent years. By leveraging its existing infrastructure and expertise, Costco has been able to quickly expand its online offerings and compete with other online retailers.

One of the key reasons why investors should consider investing in Costco is its strong financials. The company has consistently delivered solid revenue growth and profitability over the years.

2022 Highlights

Highlights from 2022 annual report for 2022 versus 2021 include:

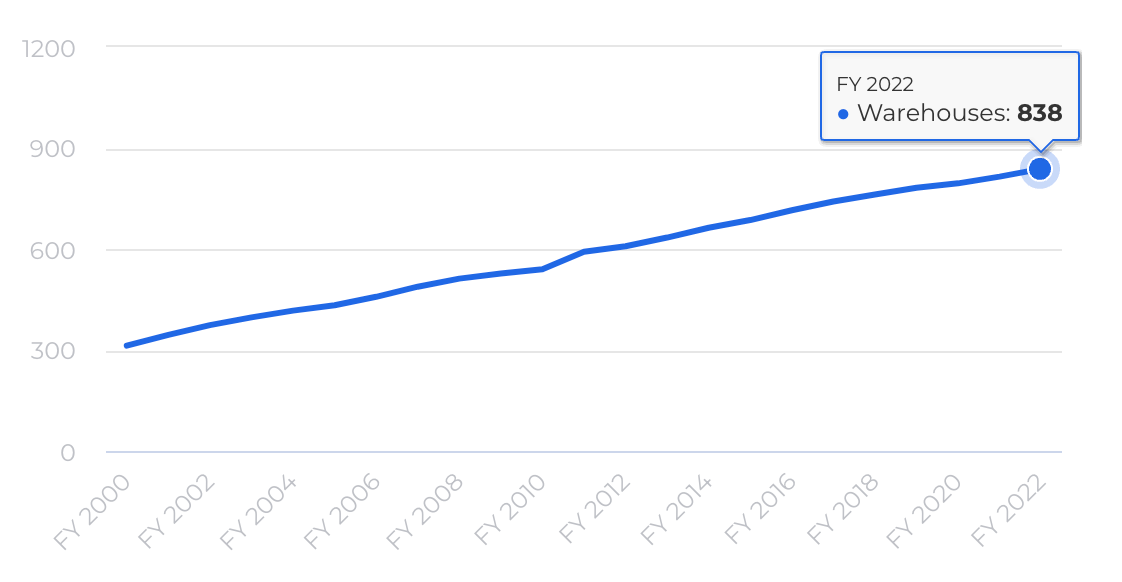

- We opened 26 new warehouses, including 3 relocations: 14 net new in the U.S., 2 net new in our Canadian segment, and 7 new in our Other International segment, compared to 22 new warehouses, including 2 relocations in 2021

- Net sales increased 16% to $222.73B driven by a 14% increase in comparable sales and sales at new warehouses opened in 2021 and 2022

- Membership fee revenue increased 9% to $4.22B, driven by new member sign-ups, upgrades to Executive membership, and an increase in our renewal rate

- The Gross margin percentage decreased by 65 basis points, driven primarily by our core merchandise categories and a LIFO charge for higher merchandise costs

- SG&A expenses as a percentage of net sales decreased 77 basis points, primarily due to leveraging increased sales and ceasing of incremental wages related to COVID-19, despite additional wage and benefits increases

- We incurred a one-time $77 pretax charge, primarily related to granting our employees one additional day of paid time off in March 2022

- The effective tax rate in 2022 was 24.6% compared to 24.0% in 2021

- Net income increased 17% to $5.84B, or $13.14 per diluted share compared to $5.00B, or $11.27 per diluted share in 2021

- In June 2022, the Company paid a cash dividend of $208 and purchased the remaining equity interest of its Taiwan operations from its former joint-venture partner for $842, totaling $1,050 in the aggregate

- In April 2022, the Board of Directors approved an increase in the quarterly cash dividend from $0.79 to $0.90 per share.

International Expansion

Costco has been expanding rapidly in international markets. In 2022, Costco had a total of 838 warehouse locations, with 578 of them located in the United States and the remaining 260 located in international markets. Costco operates in countries such as Canada, Mexico, the United Kingdom, Japan, South Korea, Taiwan, Australia, Spain, France, China, and Iceland.

International expansion has been a key driver of growth for Costco. During 2022, our international operations, including Canada, generated 27% and 32% of net sales and operating income, respectively.

E-commerce

In recent years, Costco has also invested heavily in its e-commerce capabilities. Costco has a robust e-commerce platform that allows members to shop for products online and have them delivered to their homes. The Company operates e-commerce websites in the U.S., Canada, Mexico, U.K., Korea, Taiwan, Japan, and Australia. Net sales for e-commerce represented approximately 7% of total net sales in 2022.

One of the unique features of Costco's e-commerce platform is its ability to seamlessly integrate with its brick-and-mortar stores. Members can shop online and pick up their orders at the nearest Costco warehouse, which has helped to drive traffic to its physical stores.

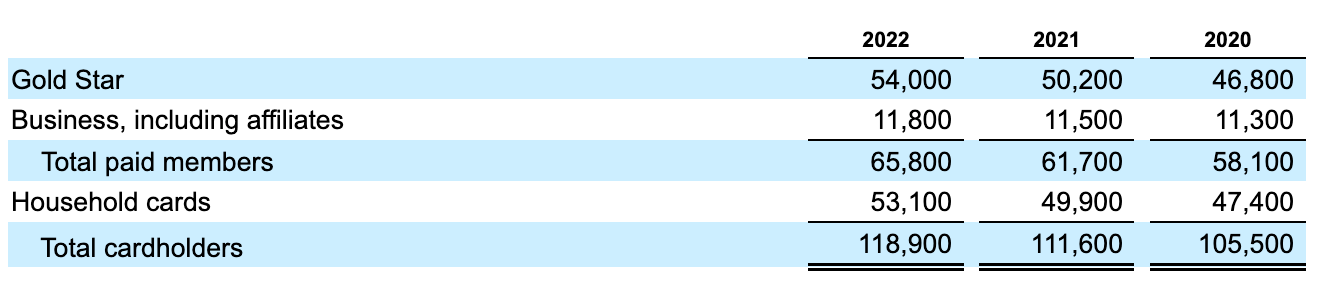

Membership

Costco's membership base continued to grow in the fiscal year 2022, reaching 118.9 million members. The company's ability to attract and retain members is a key driver of its revenue growth and profitability. Memberships are a significant source of recurring revenue for the company and also provide valuable customer data that helps the company to better understand its customer's needs and preferences. Costco's member renewal rate was 93% in the U.S. and Canada and 90% worldwide at the end of 2022.

Warehouses

Competitors

Costco has had an impressive run over the past two years, and higher-than-usual growth is finally beginning to slow down. But that changes nothing about the business model, along with the value that Costco offers, which makes it such a compelling stock to own.

Costco's moat is its strong brand as the unmatched leader in members-only shopping clubs. But two other companies operate a similar model: BJ's Wholesale Club and Sam's Club, owned by Walmart.

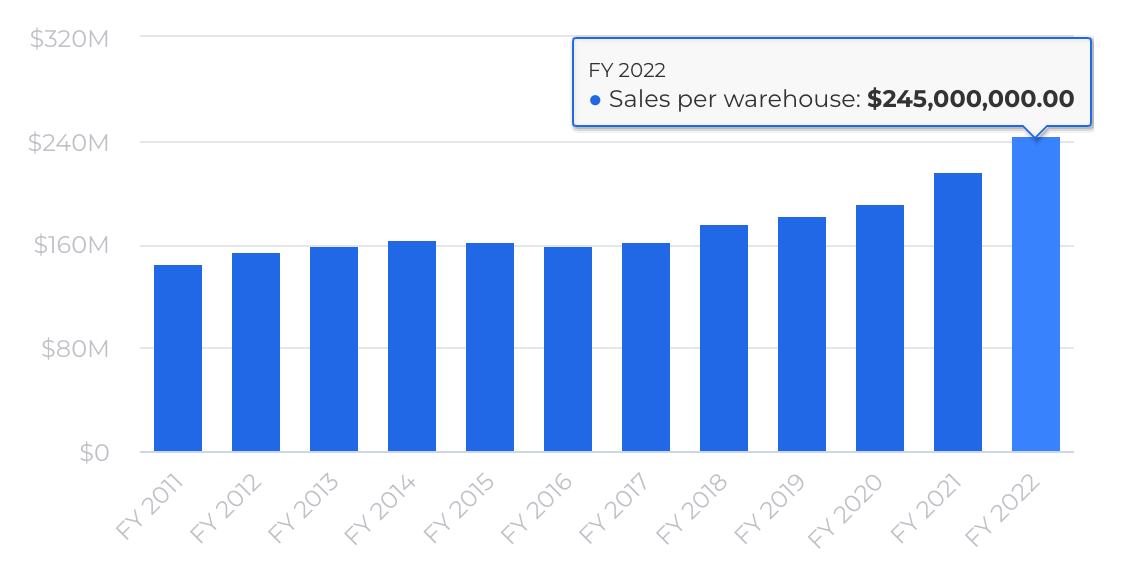

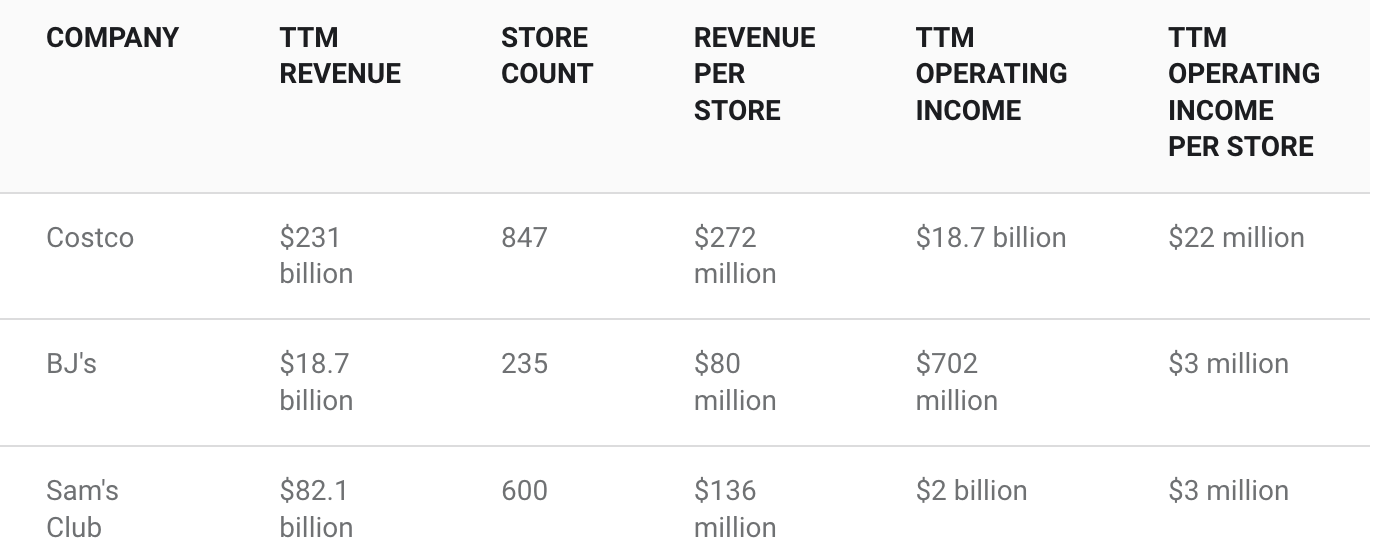

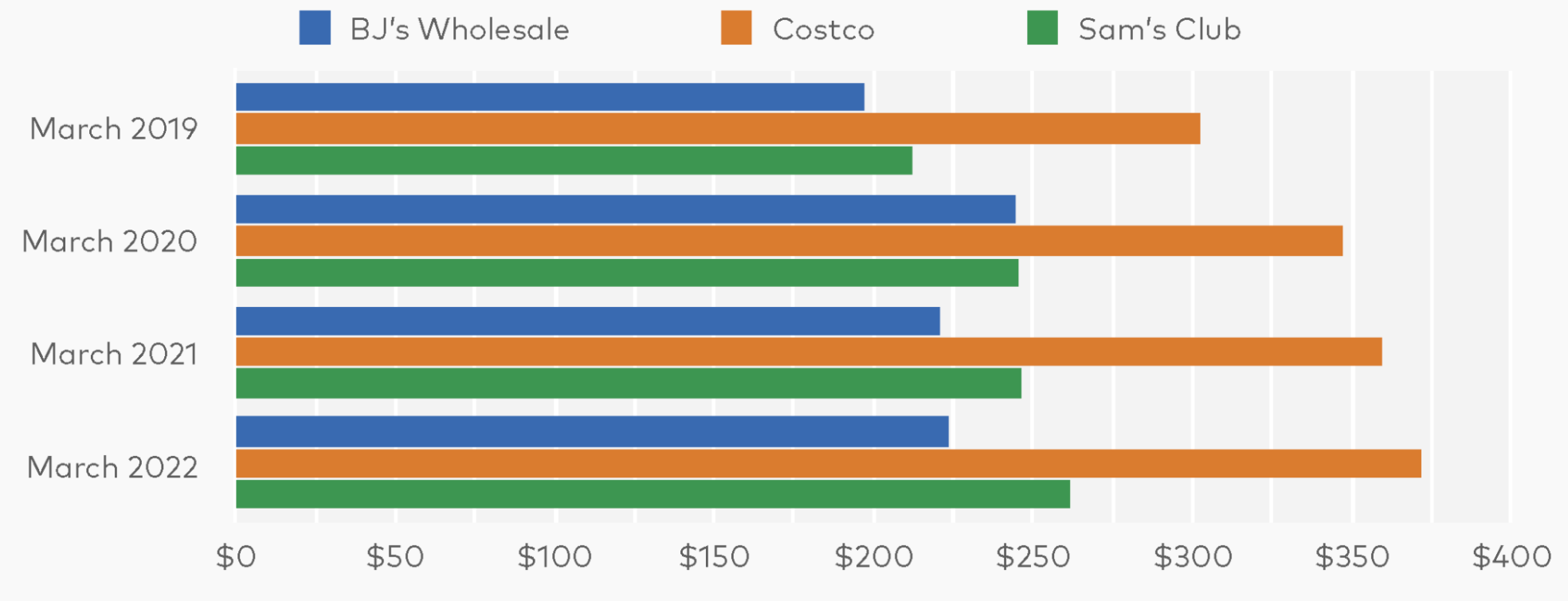

BJ's is a much smaller company, with 235 stores versus Costco's 847; Sam's Club operates 600 stores. Costco is the largest of the three, but Sam's Club isn't too far behind. However, Costco's average sales and income per store far exceed the other two. The below-mentioned data are as of Jan 24, 2023.

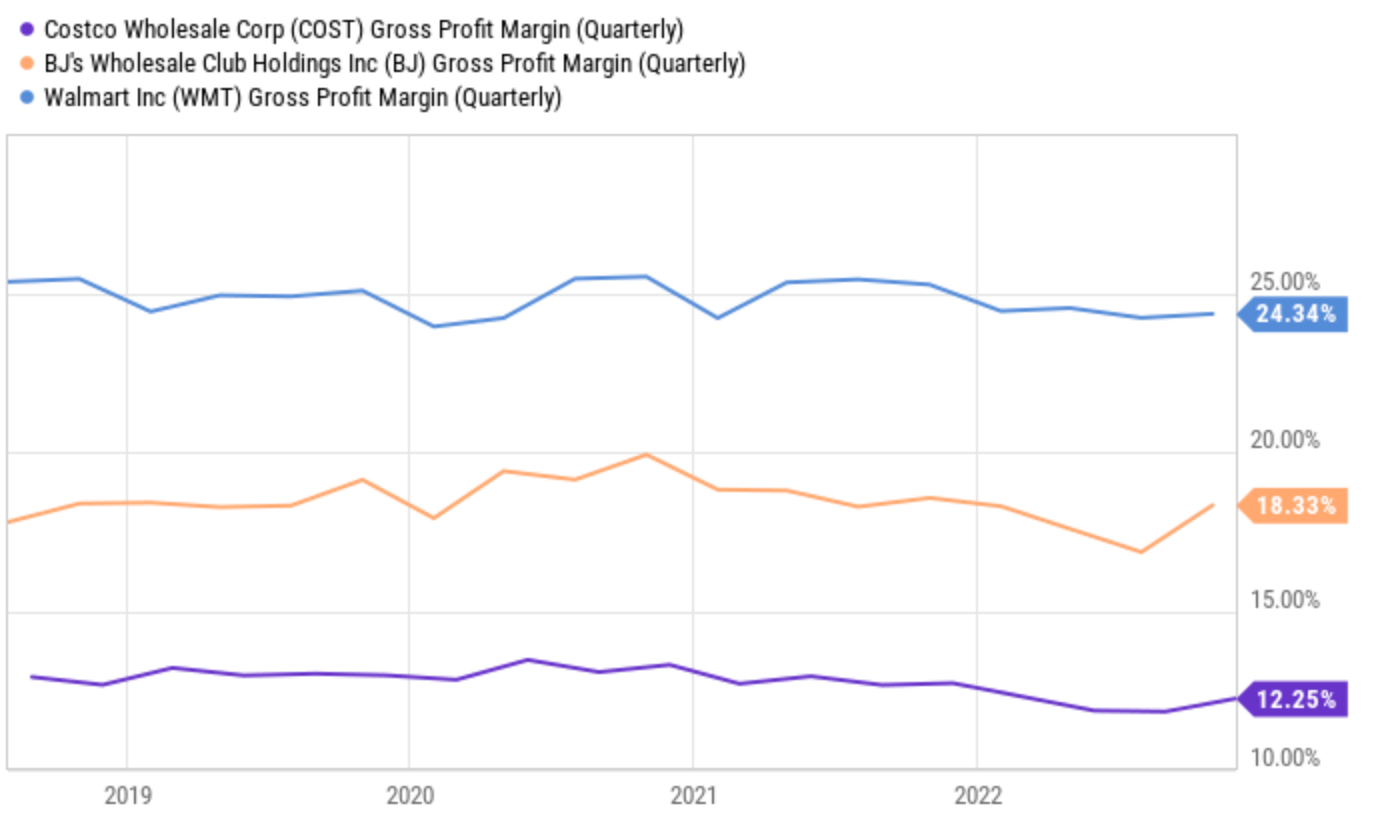

Costco's gross margin is lower than that of its competitors. Companies usually tout higher margins, but Costco deliberately keeps its markups as low as possible, resulting in low gross margins.

That formula is what makes customers loyal, generating higher sales. Strong volume trickles down to growing earnings despite the low margins, and Costco does this better than any of its small number of competitors.

Risk

While Costco's business model and financials are strong, there are some risks associated with the company. One potential risk is the company's dependence on a small number of suppliers for a significant portion of its products. Any disruption in the supply chain could adversely affect the company's operations.

Another risk is the company's reliance on its membership fees for revenue. Any significant decline in membership or renewal rates could have a negative impact on the company's financial performance.

The company's business and financial results are highly dependent on its U.S. and Canadian operations, particularly in California. Factors such as slow growth, rising operating costs, failing to meet warehouse targets, changes in economic conditions, and failure to provide innovative products could result in declining financial performance. The company's growth strategy relies on expanding its business in existing and new markets, which may be hindered by local regulations and community actions. The opening of new warehouses may negatively affect the sales and profitability of existing warehouses. Entry into new markets also poses risks such as difficulty in attracting members and competition with established market players. These factors could have a material adverse effect on the company's future growth and profitability.

The COVID-19 pandemic continued to impact business during 2022, although to a lesser extent. COVID-related and other supply and logistics constraints have continued adversely affect some merchandise categories and are expected to do so for the foreseeable future.

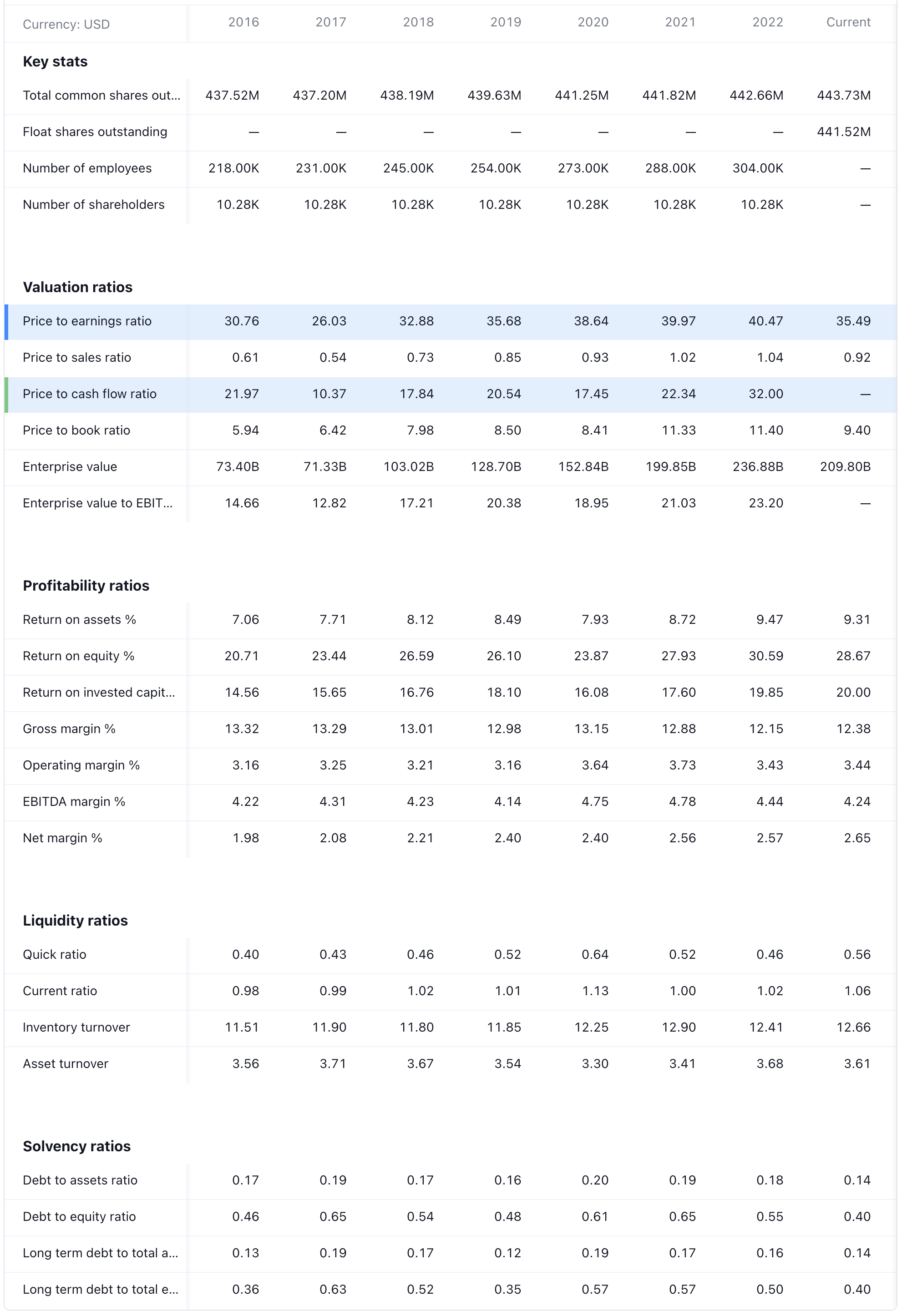

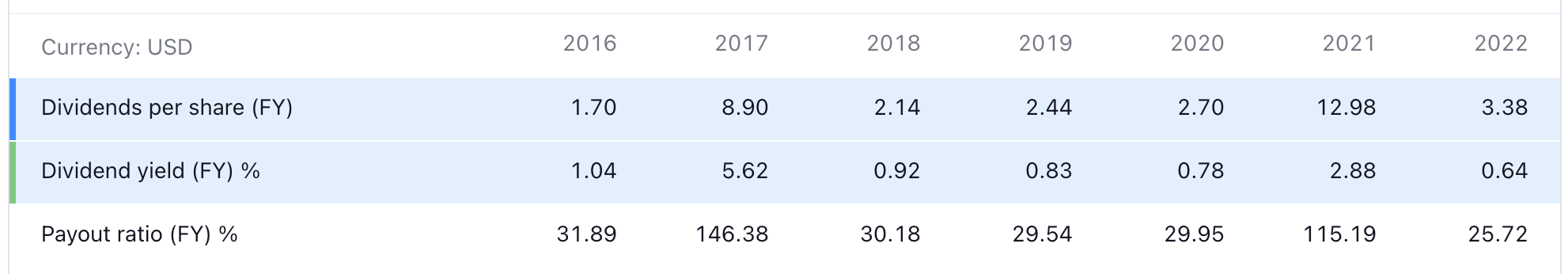

The following data snapshots are as of 3/7/2023 from tradingview website

Key Stats

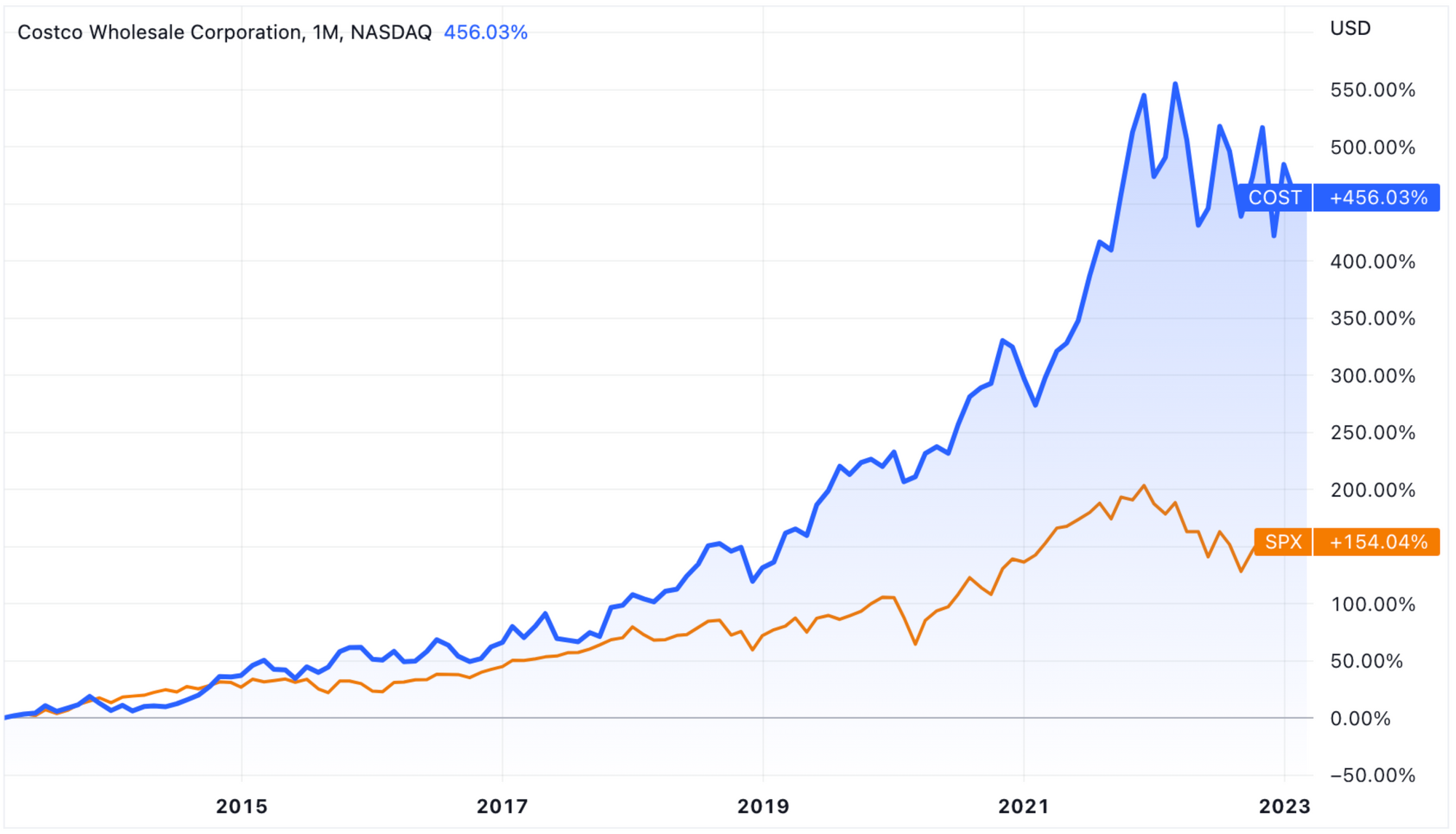

Performance

Financial Statements

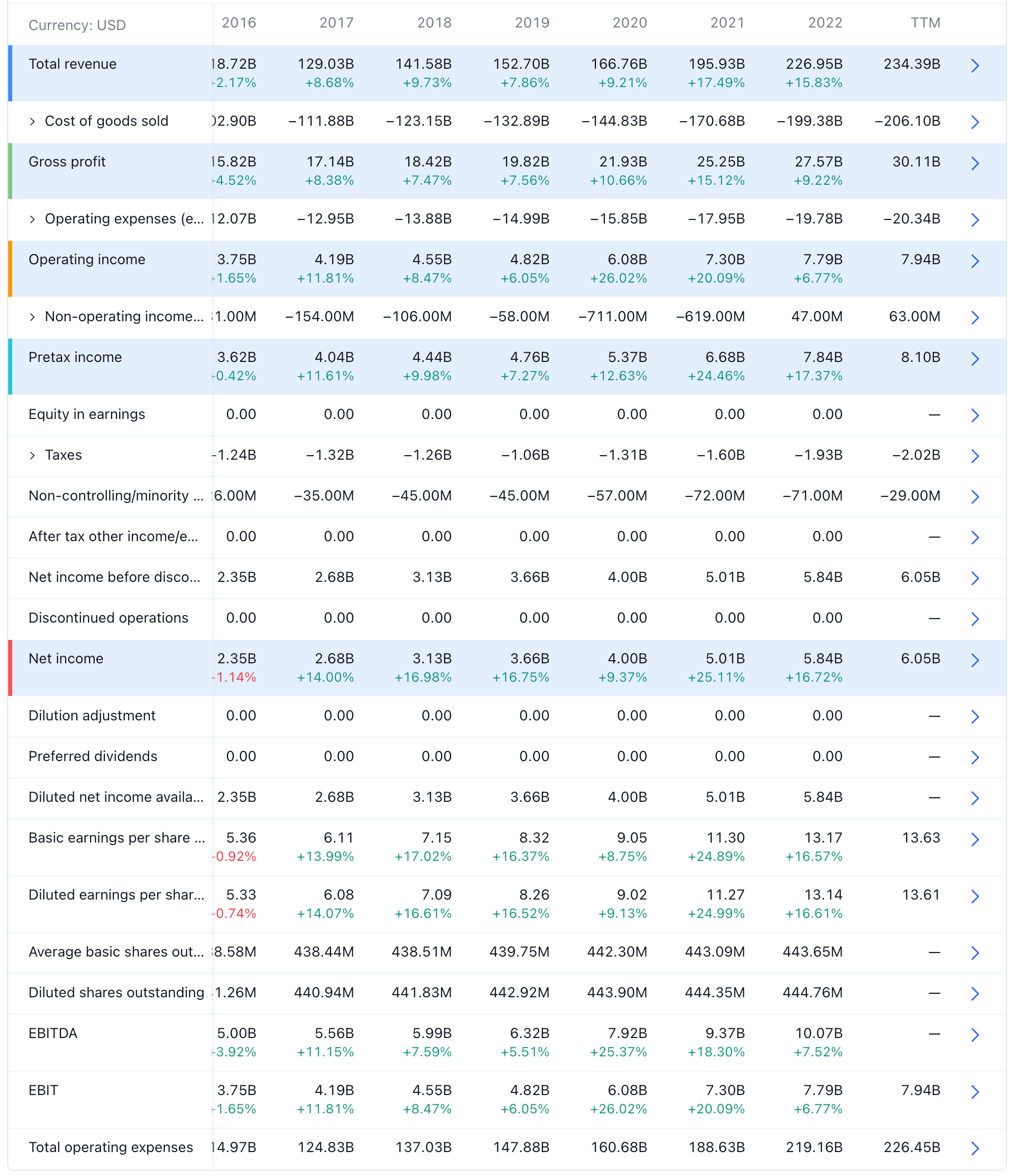

Income Statement

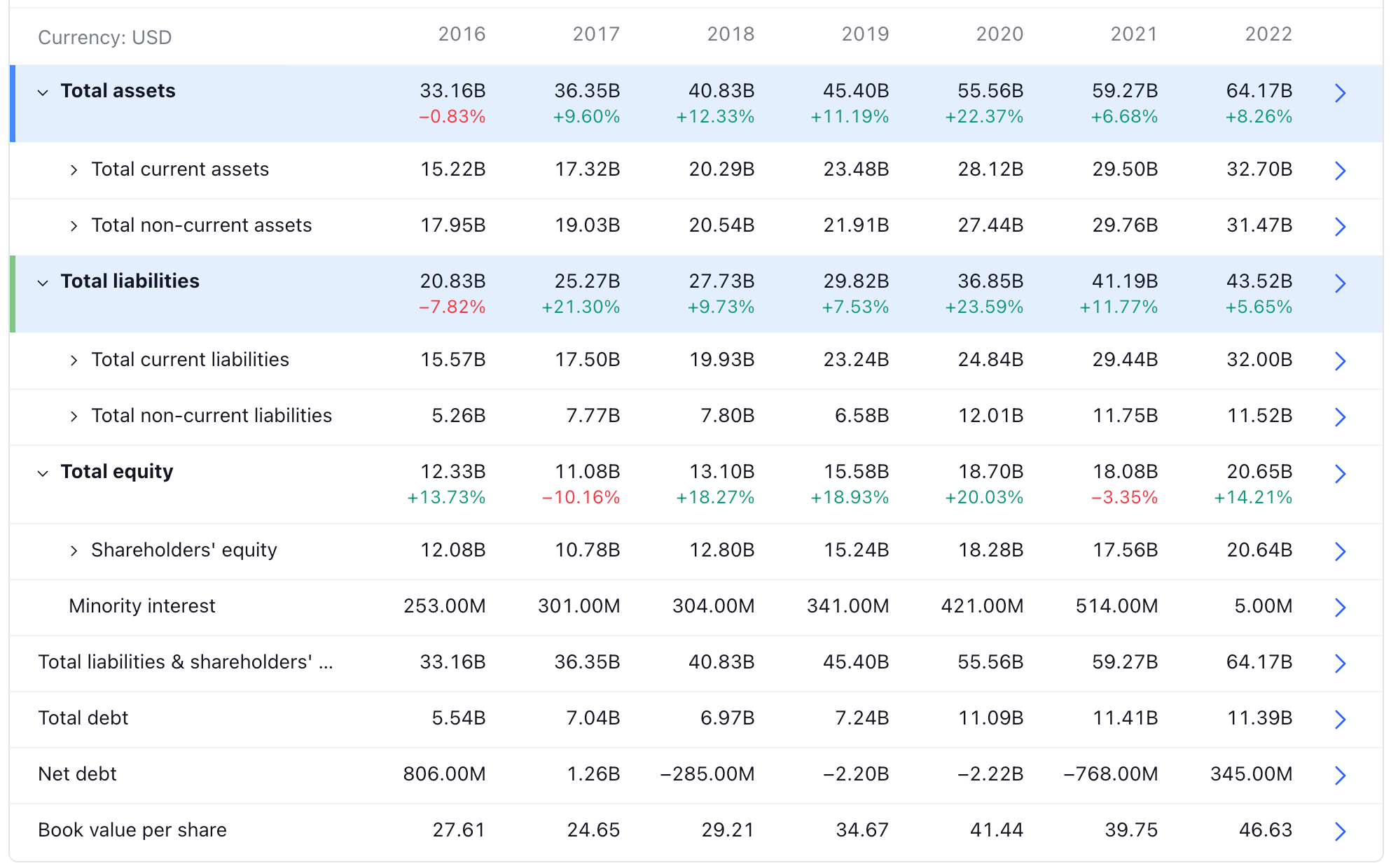

Balance Sheet

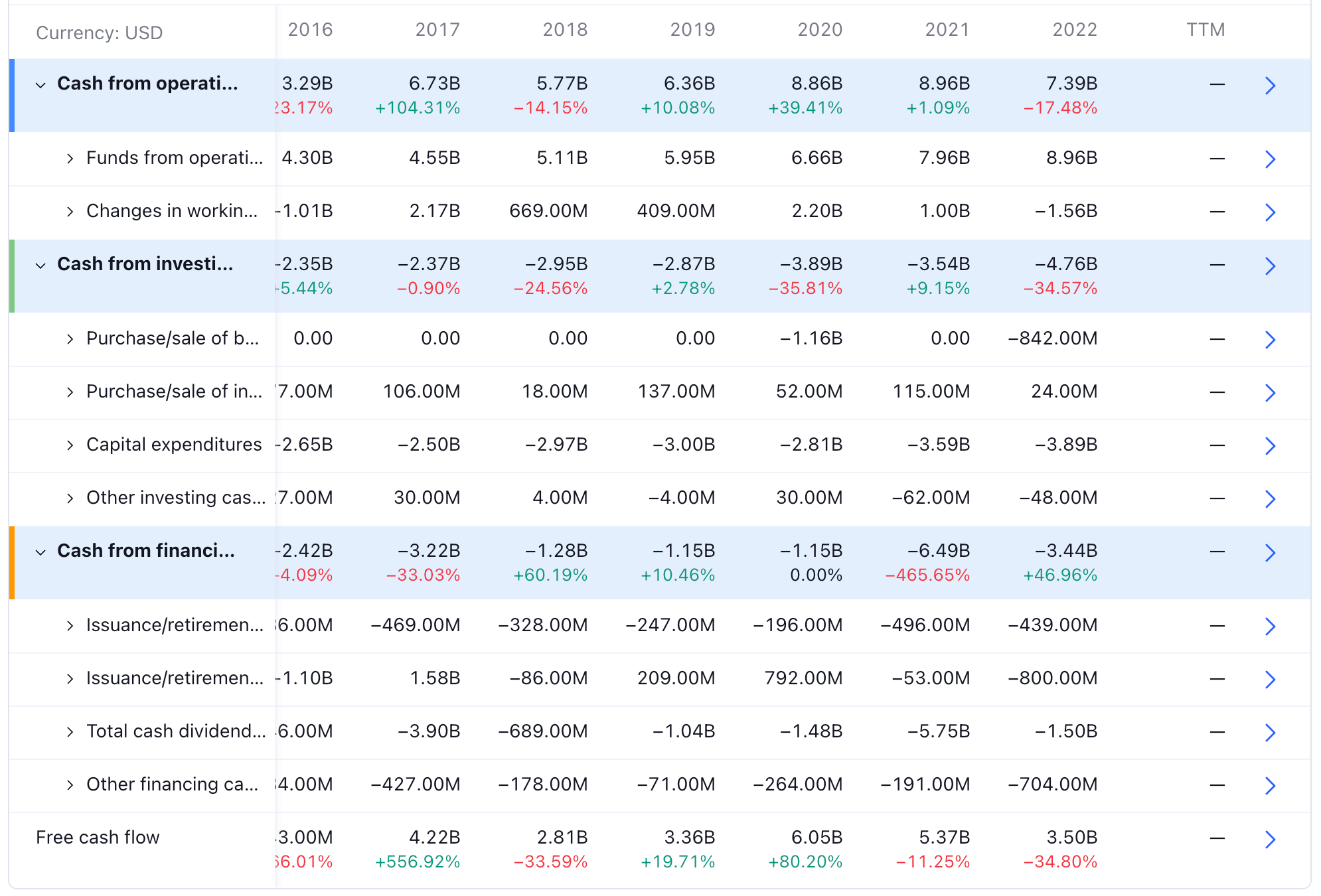

Cashflow

Statistics

Dividends

Sources: Costco Investor Relations | Trading view | WallstreetZen | Bloomberg | Fool

Unlock the power of compounding

We are changing the way that people build wealth. If your portfolio is performing below S&P 500 in the last 5 years, then you need to subscribe here. Discover remarkable stories directly to your inbox. As a subscriber, you'll receive the valuable recommendation of an exceptionally outstanding company that are designed to help you build wealth.

Gain access to exclusive benefits by subscribing today!

Disclaimer: Please note that this newsletter is a financial information publisher and not an

investment advisor. Subscribers should not view this newsletter as offering personalized legal or investment

counseling. Investors should consult with their investment advisor and review the prospectus or financial / stock

recommendation of the issuer in question before making any investment decisions. All articles, blogs, comments,

emails, and chatroom contributions - even those including the word "recommendation" - should never be construed as

official business recommendations or advice. Liability of all investment decisions resides with the individual

investor.

Snowball Investing does not provide any guarantees, warranties, or representations, whether explicitly or

implicitly, regarding the accuracy, reliability, completeness, or reasonableness of the information presented. The

opinions, assumptions, and estimates expressed represent the author's viewpoints as of the publication date and are

subject to modification without prior notification. Projections made within the document are based on various market

condition assumptions, and there is no assurance that the anticipated results will be attained. Snowball Investing

disclaims any responsibility for losses incurred due to reliance on this document's content. It is important to note

that Snowball Investing is not offering financial, legal, accounting, tax, or other professional advice, nor is it

assuming a fiduciary role.

Member discussion