Investment Thesis: Google

This issue's recommendation is one of the innovative technology companies of our generation. It has a long history of developing new products and services that have become essential parts of our lives. We believe it is an excellent choice for a long-term investment that can yield satisfactory returns.

This recommendation is just a start, the next step is to do your due diligence process which will then help you to make the investment decision. We strongly advise investors to do a thorough analysis of the recommendation and understand the soundness of the business before investing in this company. Also, please consult your investment advisor before making a decision.

Business Profile (NASDAQ: GOOGL)

Alphabet, Inc. engages in the business of delivering online advertising, cloud-based solutions that provide enterprise customers with infrastructure and platform services, the provision of communication and collaboration tools, and sales of other products and services such as apps and in-app purchases, hardware, and subscription-based products. It operates under the Google Services and Google Cloud segments. The Google Services segment includes ads, Android, Chrome, hardware, Gmail, Google Drive, Google Maps, Google Photos, Google Play, Search, and YouTube. The Google Cloud segment offers Google Cloud Platform and Google Workspace. The company was founded by Lawrence E. Page and Sergey Mikhaylovich Brin in 1998 and is headquartered in Mountain View, CA.

Story

Alphabet, also known as Google, is a wonderful long-term investment because it has a strong competitive position in the online advertising market, a history of innovation, and a healthy balance sheet. Alphabet's competitive position is based on its dominance in the search engine market. The search engine, Google, is the default search engine on most devices, and it has a very large and loyal user base. This gives Google a significant advantage in the online advertising market, as advertisers are willing to pay a premium to reach Google's users. Over the years, Alphabet has diversified its business operations and now has a presence in multiple sectors, including cloud computing, digital advertising, artificial intelligence, and consumer electronics. Its subsidiaries include YouTube, Waymo, and Verily, among others. Google developed the Android operating system, which is used on billions of devices around the world. Google also developed the Chrome web browser, which is the most popular web browser in the world. Google is in strong financial position. The company has a lot of cash and no debt. This gives Google the financial flexibility to invest in new opportunities and weather any economic downturns. Google is also a well-managed and shareholder-friendly company. It has a history of returning capital to shareholders through share buybacks and dividends.

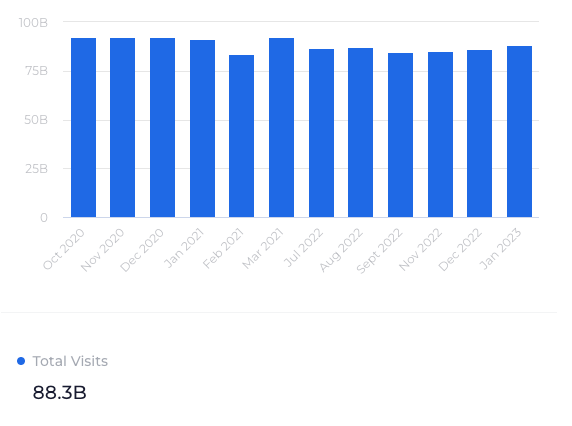

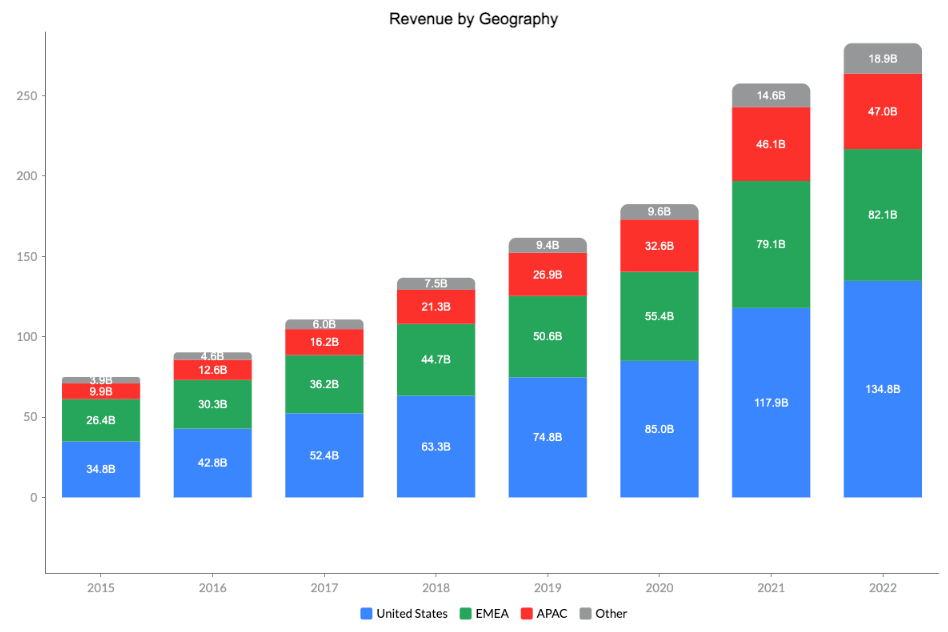

Google's customer base is also large and growing. The company has over 1.5 billion active users, and this number is expected to continue to grow in the future. Google's customers are spread all over the world, and they use the company's products and services for a variety of purposes. This makes Google an attractive investment for investors looking for exposure to the global economy.

Dominant Market Position

Google Search Engine

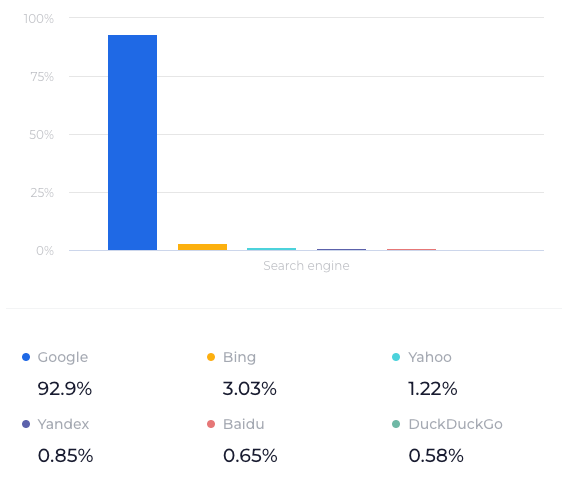

Google Search, the core product of Alphabet Inc., is the world's leading search engine, processing billions of queries each day. Google's search engine holds over 90% of the global search engine market share, far surpassing competitors like Bing, Yahoo, and Baidu. It has become synonymous with an online search, and its algorithms and artificial intelligence capabilities allow it to provide accurate and relevant results to users. This global market dominance is due to several factors, including Google's superior search algorithm, its large and growing user base, and its strong brand recognition.

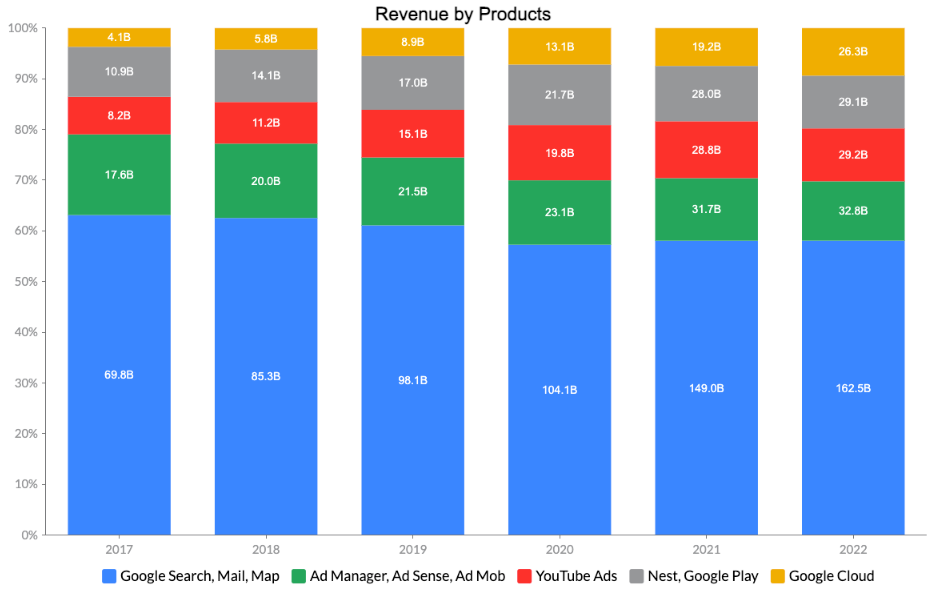

In 2022, Google generated total revenue of $228.2 billion, with advertising contributing $224.5 billion (80%) to that figure. Although Google's size is already substantial, there remains significant potential for growth. The global digital advertising market has experienced rapid expansion, doubling from $243 billion in 2017 to $568 billion in 2021, as reported by Statista. It's expected to reach $910B in 2027. These figures are much bigger than Alphabet's advertising revenue, and given the widespread presence of Google's products, each with over one billion monthly active users, the company should be well-positioned to secure a substantial portion of the market in the future.

Google's search algorithms and artificial intelligence capabilities have been refined over the years to provide the most relevant and accurate search results. Google's dominance in the search engine market gives it several advantages. First, it allows Google to collect a large amount of data about its users, which it can use to improve its products and services. Second, it gives Google a strong bargaining position with advertisers, who are willing to pay top dollar to have their ads appear at the top of Google's search results.

Google has integrated its search engine with other products and services like Google Maps, Google My Business, and YouTube, creating a seamless ecosystem that encourages users to stay within the Google universe. This enhances the overall value proposition of Google Search and further entrenches its market position.

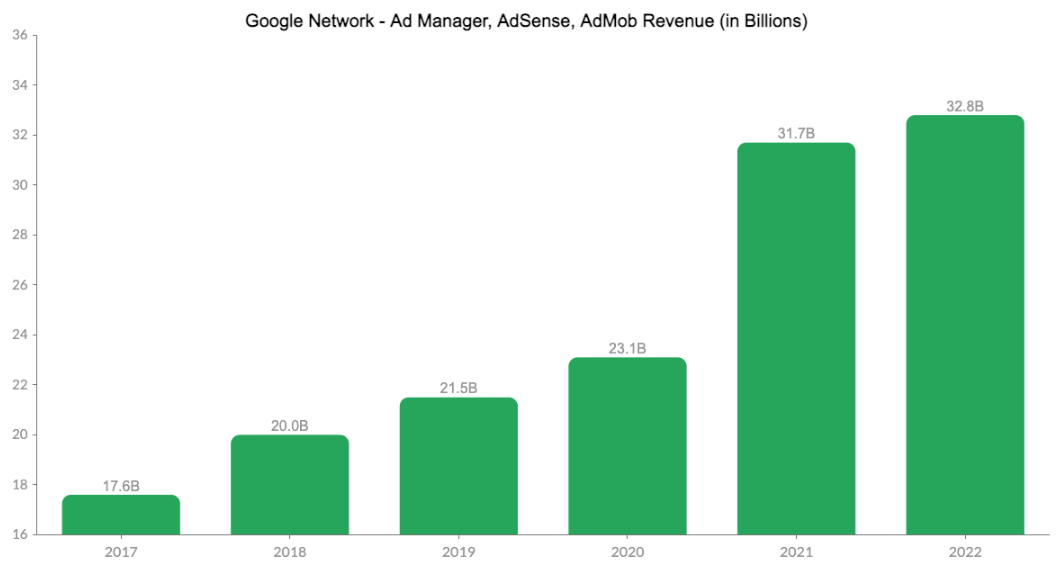

Google Network (Google Ad Manager, AdMob & AdSense)

Google Network is a suite of advertising products that helps publishers and advertisers connect and grow their businesses. Google AdMob, AdSense, and Google Ad Manager are three of the most popular products in the Google Network.

AdMob is a mobile advertising platform that allows app developers to monetize their apps by displaying targeted advertisements. AdSense is a program that enables website owners and publishers to monetize their content by displaying relevant advertisements. Google Ad Manager is a comprehensive ad management platform that combines the capabilities of DoubleClick for Publishers (DFP) and DoubleClick Ad Exchange (AdX). It enables publishers to manage their ad inventory, streamline ad operations, and optimize revenue across multiple channels, including display, video, and mobile.

Google Network, through its various products, has established itself as the market leader in the digital advertising space. It holds a dominant position in both display and mobile advertising, offering advertisers and publishers unparalleled reach and scale. Google's advanced data analytics and machine learning capabilities allow for precise ad targeting based on user behavior, interests, and demographics. This ensures that ads are relevant to users, which increases engagement and conversion rates, benefiting both advertisers and publishers.

Google's massive user base, data-driven targeting capabilities, and extensive advertiser and publisher relationships create a significant barrier to entry for competitors. This competitive advantage ensures the long-term sustainability of Google Network's market position.

YouTube

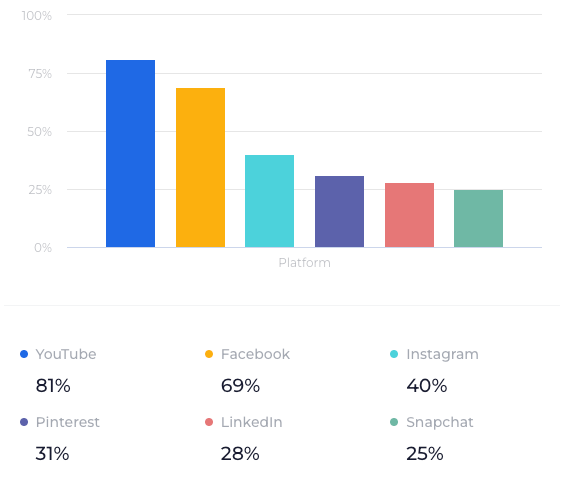

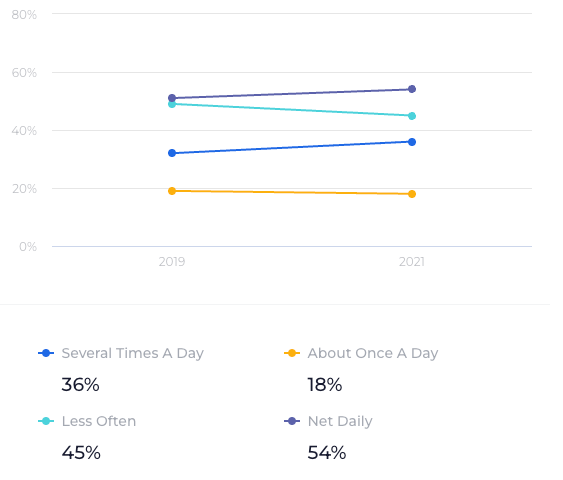

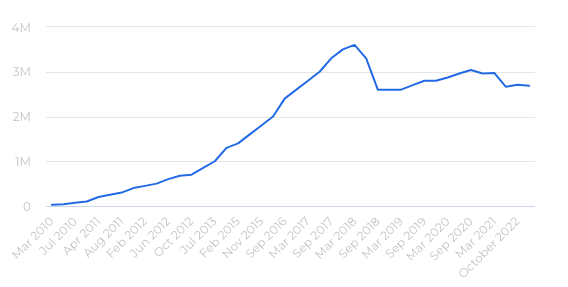

YouTube is the world's leading video-sharing platform, allowing users to upload, share, and watch videos across various categories such as music, gaming, education, and entertainment. Founded in 2005 and acquired by Google in 2006, YouTube has grown into a dominant force in the online video industry, boasting over 2.6 billion logged-in monthly users and millions of content creators.

YouTube has established itself as the go-to platform for online video consumption, holding a dominant position in the global video-sharing market. With its vast user base and extensive content library, YouTube offers unparalleled reach for advertisers and content creators.

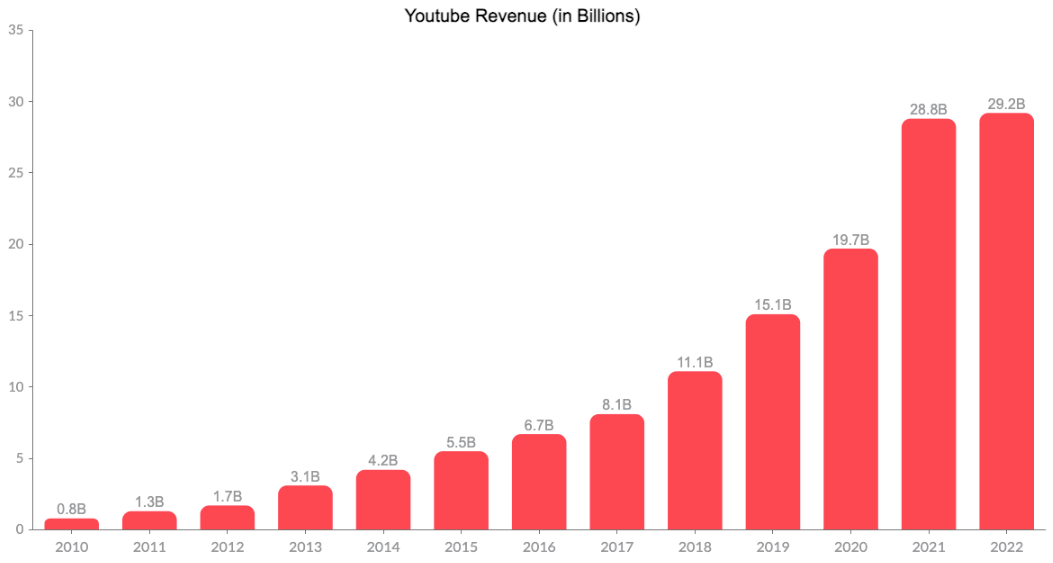

YouTube generates significant advertising revenue through its various ad formats, such as display, overlay, and skippable video ads. As the digital advertising market continues to grow, YouTube is poised to benefit from this trend and maintain its growth trajectory. YouTube has expanded its revenue streams by introducing subscription-based services like YouTube Premium and YouTube TV. These offerings provide an ad-free experience, access to exclusive content, and live TV streaming, respectively. The growth of these services contributes to YouTube's overall financial performance and reduces its dependence on advertising revenue. YouTube generates substantial revenue from digital advertising and subscription-based services, creating a stable and growing revenue stream that provides long-term value for investors.

YouTube's platform hosts a wide range of content, catering to diverse interests and demographics. This variety attracts a broad audience, ensuring consistent user engagement and creating a vibrant community of content creators and viewers. YouTube has localized its platform in over one hundred countries and supports multiple languages, enhancing its appeal to a global audience. This international reach ensures that YouTube can continue to grow its user base and generate revenue from diverse markets.

YouTube's integration with the broader Google ecosystem, including Google Search and Google Ads, provides synergistic benefits, driving traffic to the platform and enhancing its advertising capabilities.

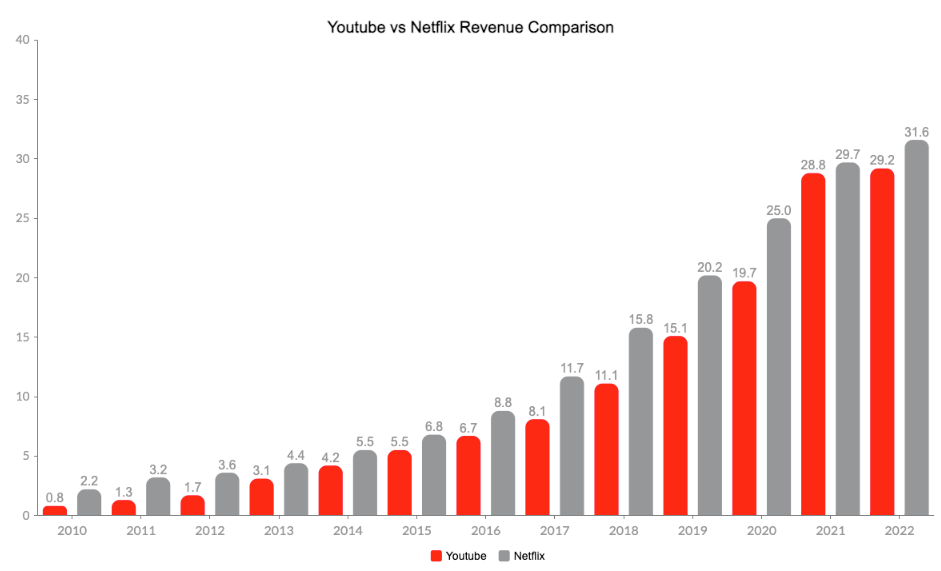

YouTube Ads vs Netflix

YouTube and Netflix are two of the most popular streaming services in the world. YouTube has a larger user base than Netflix, but Netflix has a higher subscription price. YouTube also has a wider variety of content than Netflix, but Netflix has more original content. YouTube is free to use, and primarily generates revenue through advertising, but it offers a premium subscription that includes ad-free viewing and access to exclusive content. Netflix produces a variety of original TV shows and movies, while YouTube does not produce any original content. YouTube offers live-streaming content, while Netflix does not. YouTube users can watch live streams of events, such as music concerts and sporting events.

YouTube has over 2.6 billion active users, while Netflix has over 230 million subscribers. YouTube's larger user base and global reach provide it with a significant advantage in terms of potential growth, especially as it expands its monetization efforts through subscriptions and other revenue streams. In terms of revenue, Netflix generated $31.6 billion in revenue in 2022, while YouTube generated $29.2 billion. However, YouTube is growing its revenue faster than Netflix. Youtube is closing the gap slowly. YouTube's revenue grew by 29% from 2017 to 2022, while Netflix's revenue grew by just 22% for the same period. Similarly, YouTube's profitability is increasing faster than Netflix's.

While both YouTube and Netflix operate in the online video industry, they cater to different user needs and follow distinct business models. Comparing the two platforms, YouTube offers several advantages that make it an attractive long-term investment based on value investing principles.

YouTube's wide range of user-generated content appeals to a broader audience, ensuring consistent user engagement and creating a vibrant community of content creators and viewers. As a subsidiary of Alphabet Inc., YouTube benefits from the parent company's strong financials, providing it with the resources to invest in future growth opportunities and weather potential economic downturns.

Google Cloud

Google Cloud is a suite of cloud computing services that runs on the same infrastructure that Google uses internally for its end-user products, such as Google Search and YouTube. Alongside a set of management tools, it provides a series of modular cloud services including computing, data storage, data analytics, and machine learning that includes infrastructure-as-a-service (IaaS), platform-as-a-service (PaaS), and software-as-a-service (SaaS) offerings. Google Cloud's presence in the rapidly expanding cloud computing market provides significant growth potential as more businesses transition to cloud-based solutions.

The global cloud computing market is experiencing rapid growth as businesses increasingly adopt cloud services to improve operational efficiency, scalability, and agility. Google Cloud is well-positioned to capture a significant share of this expanding market. Google Cloud offers a comprehensive suite of products and services that can compete with established players like Amazon Web Services (AWS) and Microsoft Azure. Its offerings include AI and machine learning capabilities, data analytics, and storage solutions, which cater to the diverse needs of businesses across various industries.

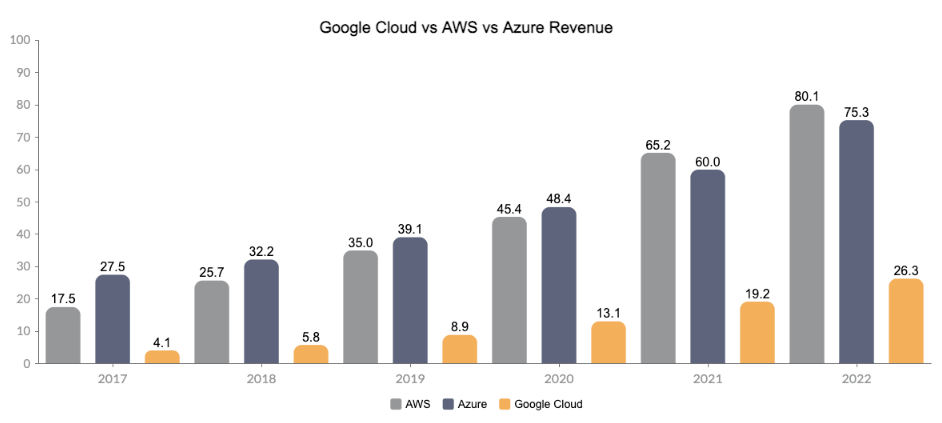

Google Cloud has established strategic partnerships with key industry players such as Cisco, SAP, and Salesforce, which bolsters its credibility and reach. It has also attracted a diverse customer base, including high-profile clients like Spotify, Twitter, and Snap Inc. Google Cloud is a leading player in the cloud computing market. It is the third-largest cloud provider by market share, after Amazon Web Services (AWS) and Microsoft Azure. Google Cloud is growing rapidly, and it is expected to continue to grow in the future and closing the gap in market shares with AWS & Azure.

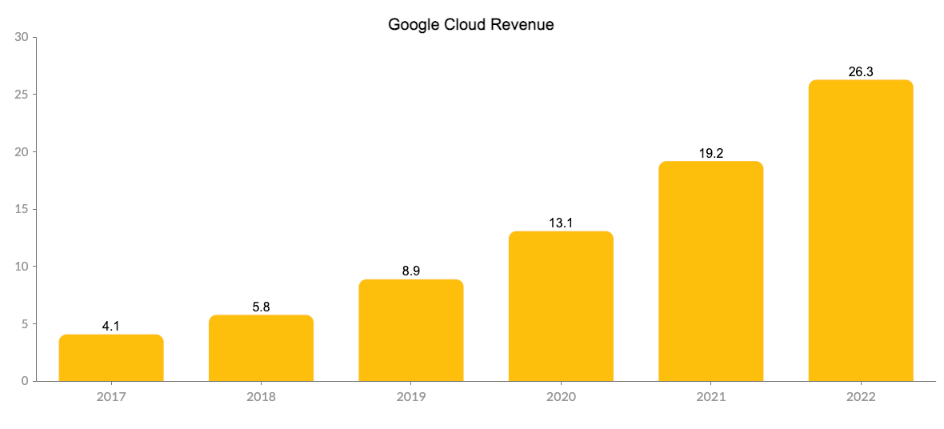

Google Cloud represents another growth opportunity for Alphabet. Precedence Research predicts that the public cloud computing market will expand at a nearly 17% annual rate, increasing from $380B in 2021 to $1.6T by 2030. Google Cloud Platform holds a 9% market share, trailing behind Amazon's AWS (32%) and Microsoft's Azure (20%), making it a fiercely competitive landscape. Nevertheless, Google Cloud's revenue experienced a substantial 37% increase in 2022 compared to the previous year, reaching $26.3B. This growth follows an impressive annual revenue increase of 45% for Google Cloud between 2017 ($4.1B) and 2022 ($26.3B). We believe that the overall growth of the cloud computing sector will benefit multiple players, including Google Cloud.

Android / Google Play

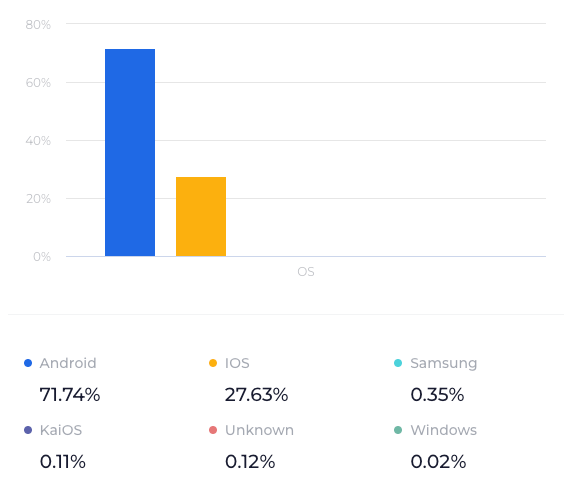

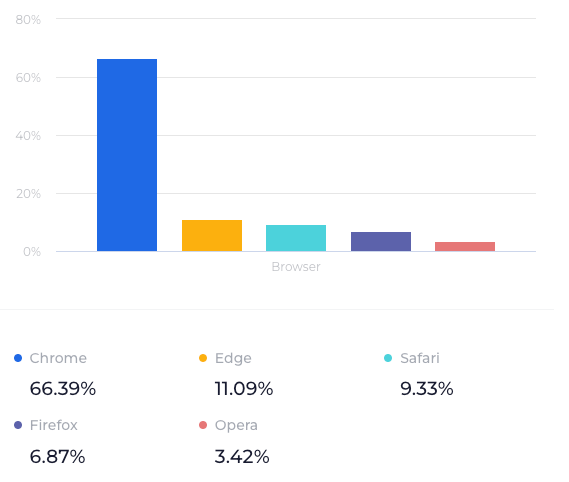

Android is the world's most popular mobile operating system. It is used on over 2.5 billion devices, and it is growing rapidly in emerging markets. Android is a key part of Google's ecosystem, and it is a major driver of the company's growth.

Chrome

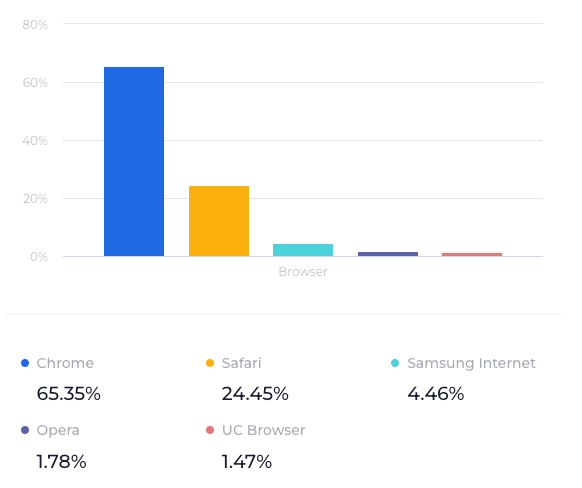

Chrome is the world's most popular web browser. It is used on over 65% of all devices, and it is growing rapidly in emerging markets. Chrome is a key part of Google's ecosystem, and it is a major driver of the company's growth.

The dominant positions held by Android and Chrome in their respective markets, provide a sustainable competitive advantage that ensures long-term growth. Android and Chrome contribute to Alphabet's stable and growing revenue streams, providing long-term value for investors. Android and Chrome serve as platforms for growth, enabling Google to leverage its user base, technology, and data to create new revenue streams and strengthen its overall ecosystem.

Diversified Revenue Streams

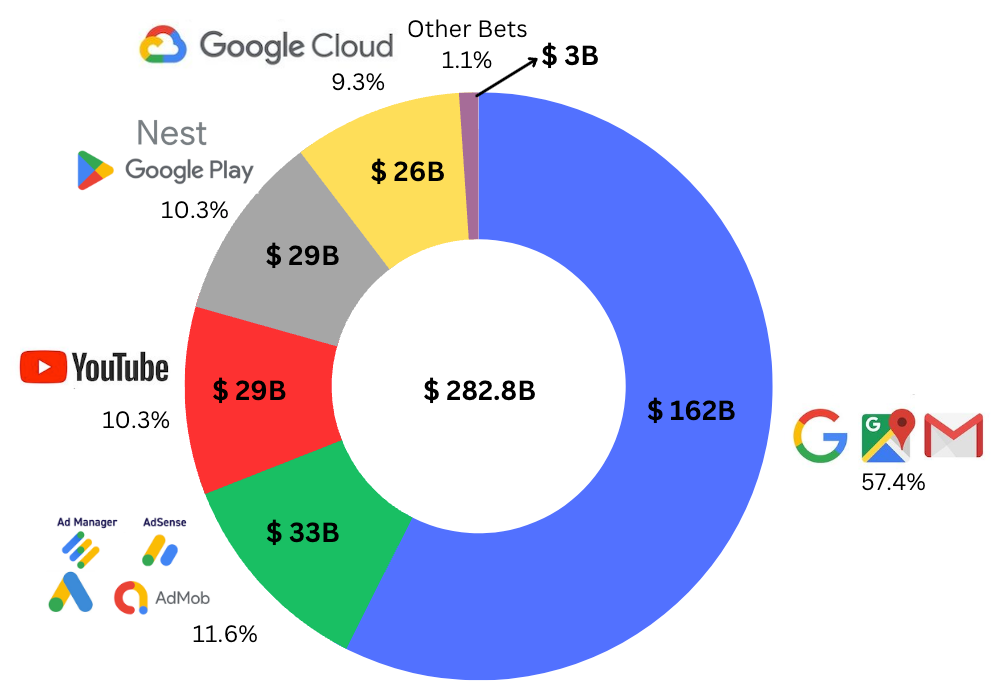

Google is a well-diversified company with a strong track record of growth. The company's revenue comes from a variety of sources, including advertising, cloud computing, YouTube, Android, and hardware sales. This diversification makes Google less vulnerable to changes in any one market.

Google's advertising business is the company's largest source of revenue. Apart from advertising, Google's diversified revenue comes from Google Cloud, Hardware, Subscription-based services, and Google Play. It helps mitigate risks associated with fluctuations in the advertising market and provides more stability and predictability for Google's financial performance. This diversification ensures the company's financial stability and resilience during economic downturns.

Google continues to invest in and develop new products and services, it can capitalize on the growth potential of emerging markets and technologies. Many of Google's revenue streams are interconnected, allowing the company to leverage synergies between its products and services. This interconnected ecosystem drives customer loyalty and creates additional growth opportunities for Google.

Google's diversified revenue streams, reduced dependence on advertising, growth potential, and synergies between products and services make it an attractive long-term investment.

Network Effects

Google is a company that has been able to grow its business significantly over the past few years. One of the main reasons for this growth is the company's use of network effects. As more users adopt Google's products and services, the company benefits from increased user engagement, data collection, and revenue generation opportunities. This expanding user base further solidifies Google's market leadership.

As more users choose Google Search, the search engine becomes more valuable to advertisers, who are willing to pay a premium for access to this large and engaged audience. This, in turn, attracts more advertisers, creating a virtuous cycle that strengthens Google's market position and generates significant revenue.

As the most widely used mobile operating system globally, Android benefits from network effects by attracting developers to create apps for its platform, which in turn attracts more users. This cycle contributes to Android's sustained growth and dominance in the mobile operating system market.

The more users upload and watch content on YouTube, the more valuable the platform becomes for content creators and advertisers. This virtuous cycle of network effects drives YouTube's growth and cements its position as the world's leading video-sharing platform.

Google Ads and AdSense: Network effects drive growth in Google's advertising business by attracting more advertisers and publishers to its platforms. As more businesses advertise on Google, the platform becomes more valuable for publishers, who in turn generate more ad inventory and attract even more advertisers.

Google's ability to leverage network effects across its products and services has significant implications for its long-term investment potential. Overall, Google uses network effects to its advantage in a number of ways. This helps the company to grow its business and reach more people around the world.

Leadership

Google is primarily owned by its founders, As of December 31, 2020, Larry Page and Sergey Brin beneficially owned approximately 85.3% of our outstanding Class B common stock, which represented approximately 51.5% of the voting power of outstanding common stocks. Sergey Brin’s stake in the company is worth approximately $66.1B. Larry Page’s stake in the company is worth approximately $69.5B. Page and Brin will effectively call the shots at Alphabet. They have huge economic stakes that are tied to their Alphabet shares, so their interests should be nicely aligned with those of Alphabet’s other shareholders.

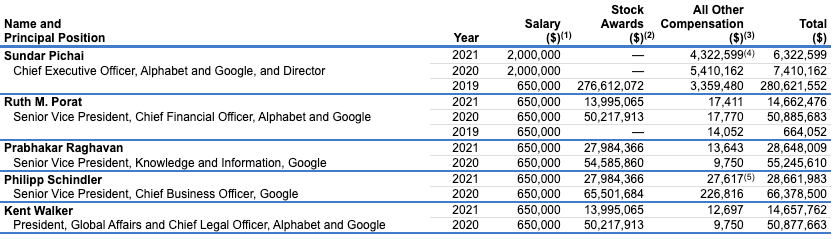

The key leader at Alphabet now is Sundar Pichai, 47, who first joined Google in April 2004 and steadily rose through the ranks. Before assuming the Alphabet CEO role in December 2019, he became CEO of Google in October 2015. We appreciate both Pichai’s relatively young age and long tenure at Alphabet/Google. The other key Alphabet leader is CFO Ruth Porat, who joined the company as Google’s CFO in May 2015 before assuming her current role in October of the same year after Google restructured to create Alphabet.

Alphabet has a very well-structured compensation scheme for executives. Pichai's stock awards consist of two elements: Performance Stock Units (PSUs) and Google Stock Units (GSUs). The PSUs are divided into two parts – the first tranche vests over two years, while the second tranche vests over three years. The number of shares granted for both tranches depend on Alphabet's stock total return during the vesting period. Pichai may receive anywhere from 0% (if Alphabet's stock performance ranks below the 75th best-performing stock in the S&P 100 during the vesting period) to 200% (if Alphabet is among the top 25 best-performing stocks in the S&P 100 for the vesting period) of the target number of shares for each PSU tranche. Similarly, GSUs are also split into two parts. The first tranche vests quarterly over one year. The second tranche vests quarterly over three years.

The majority of the total compensation of Alphabet’s key leaders came from PSUs and GSUs (Google Stock Unit) which is designed to align their interests with those of shareholders.

Google is a company that has been able to create significant value for its shareholders over the past few years. The company has a strong track record of growth, and it is well-positioned to continue to grow in the future. Google's growth is driven by several factors, including its strong brand, its large user base, and its technological expertise. The company's brand is one of the most valuable in the world, and it gives Google a significant advantage in the market.

Google's growth is also benefiting its shareholders. The company has a history of returning capital to shareholders through share buybacks and dividends. In recent years, Google has returned billions of dollars to shareholders through these programs. This has helped to boost the company's stock price, and it has also made Google an extremely attractive long-term investment.

Risk

Competition: Alphabet faces intense competition from major technology companies like Amazon, Microsoft, Apple, and Facebook. These competitors may challenge Alphabet's market share across various sectors, potentially impacting its growth and profitability. Alphabet faces competition from Microsoft's Bing, Yahoo, and DuckDuckGo in the Search market. In Online advertising, Alphabet faces competition from Facebook, Amazon, and Twitter. Alphabet faces competition from Amazon Web Services (AWS), Microsoft Azure, and IBM Cloud in the cloud computing market.

Regulatory and legal risks: Alphabet is subject to regulatory and legal scrutiny across multiple jurisdictions, particularly regarding privacy, antitrust, and data protection laws. Any adverse outcomes or stricter regulations could negatively affect the company's operations, reputation, and financial performance. For example, In March 2023, the U.S. Department of Justice filed a lawsuit against Alphabet, alleging that the company has abused its dominance in the online search and advertising markets. The lawsuit seeks to break up Alphabet.

Reliance on advertising revenue: Despite Alphabet's diversified revenue streams, a sizable portion of its income is still derived from advertising. Economic downturns or changes in advertising spending patterns could impact on the company's revenues and profitability.

Technological changes and innovation: Alphabet operate in a rapidly evolving industry that requires constant innovation and adaptation to stay competitive. Failure to keep up with technological advancements or develop new products and services may harm the company's growth prospects. ChatGPT is acquiring more market share as it becomes more popular, and more people become aware of its capabilities. This could pose a risk to Google, as ChatGPT could become a substitute for Google's search engine and other products and services.

Key personnel risk: Alphabet's success relies heavily on the expertise and leadership of its key personnel, such as executives like Sundar Pichai and engineers. The loss of key individuals or an inability to attract and retain talent may negatively impact the company's performance and growth.

Economic downturn: Alphabet's business is highly dependent on the global economy. If the economy were to enter a recession, Alphabet's revenue and profits could decline.

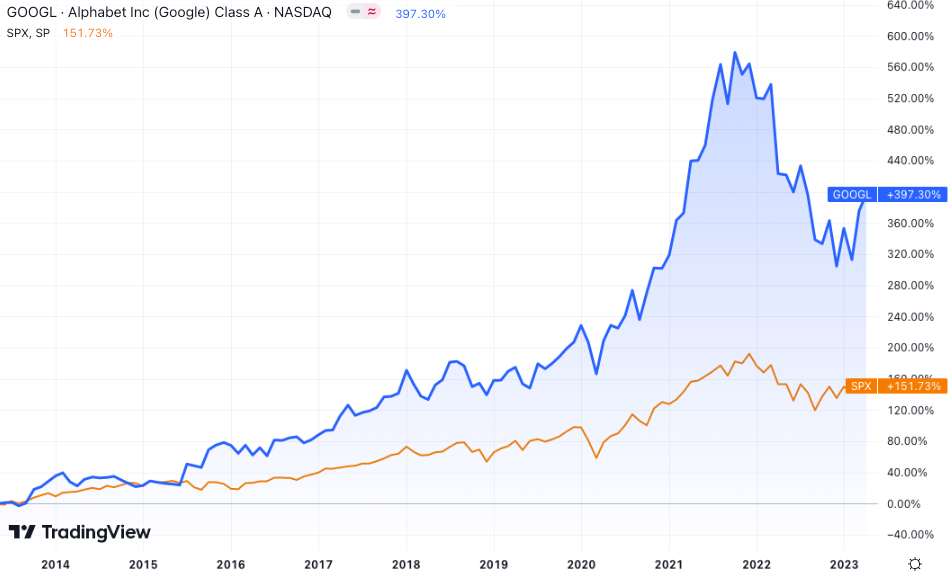

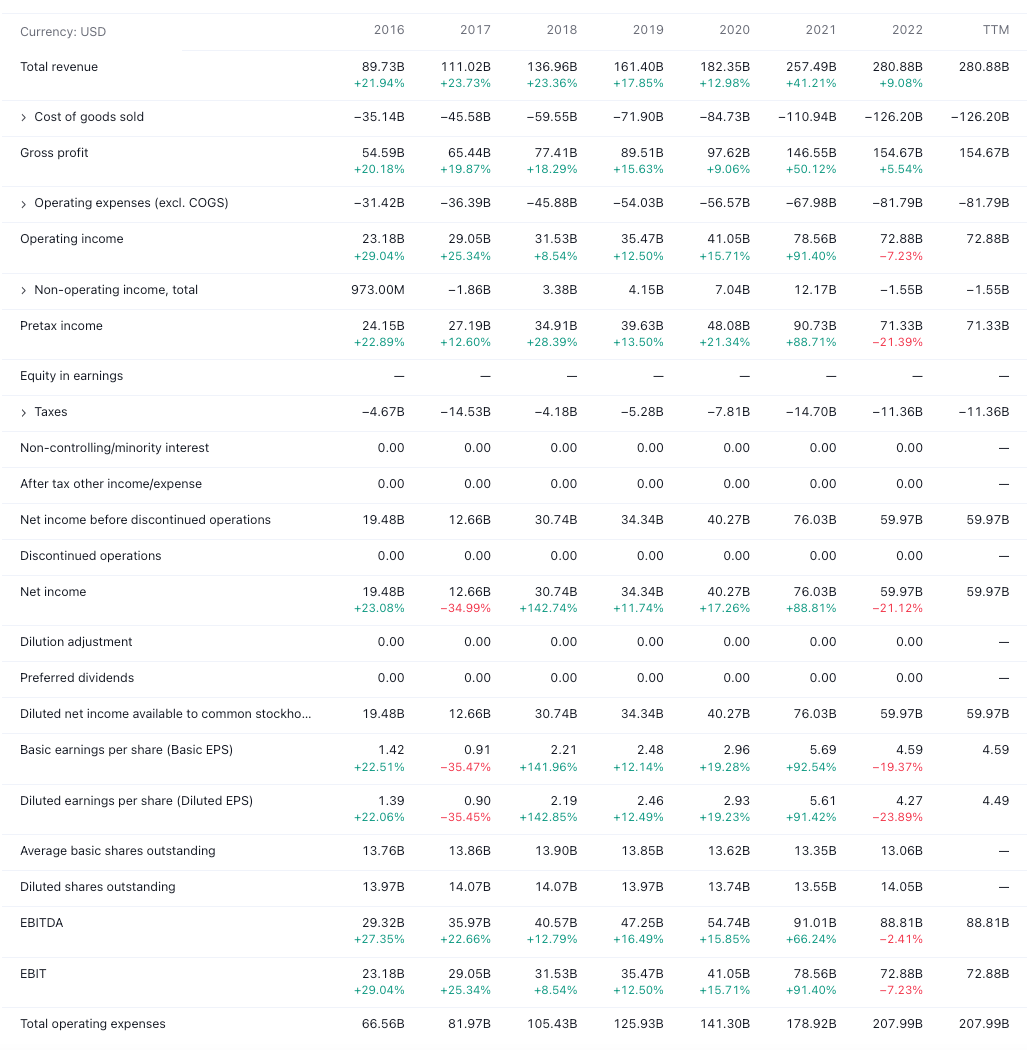

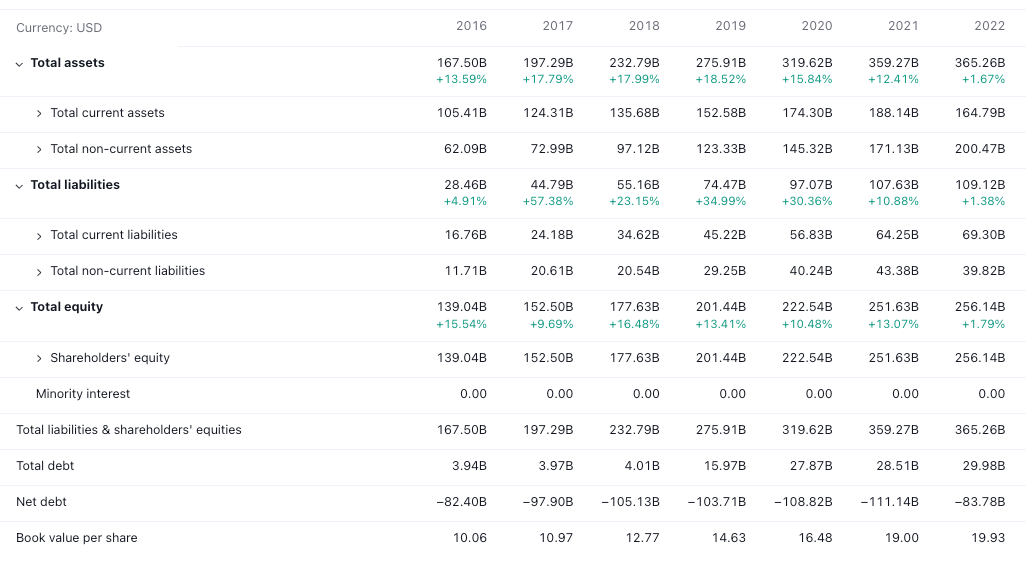

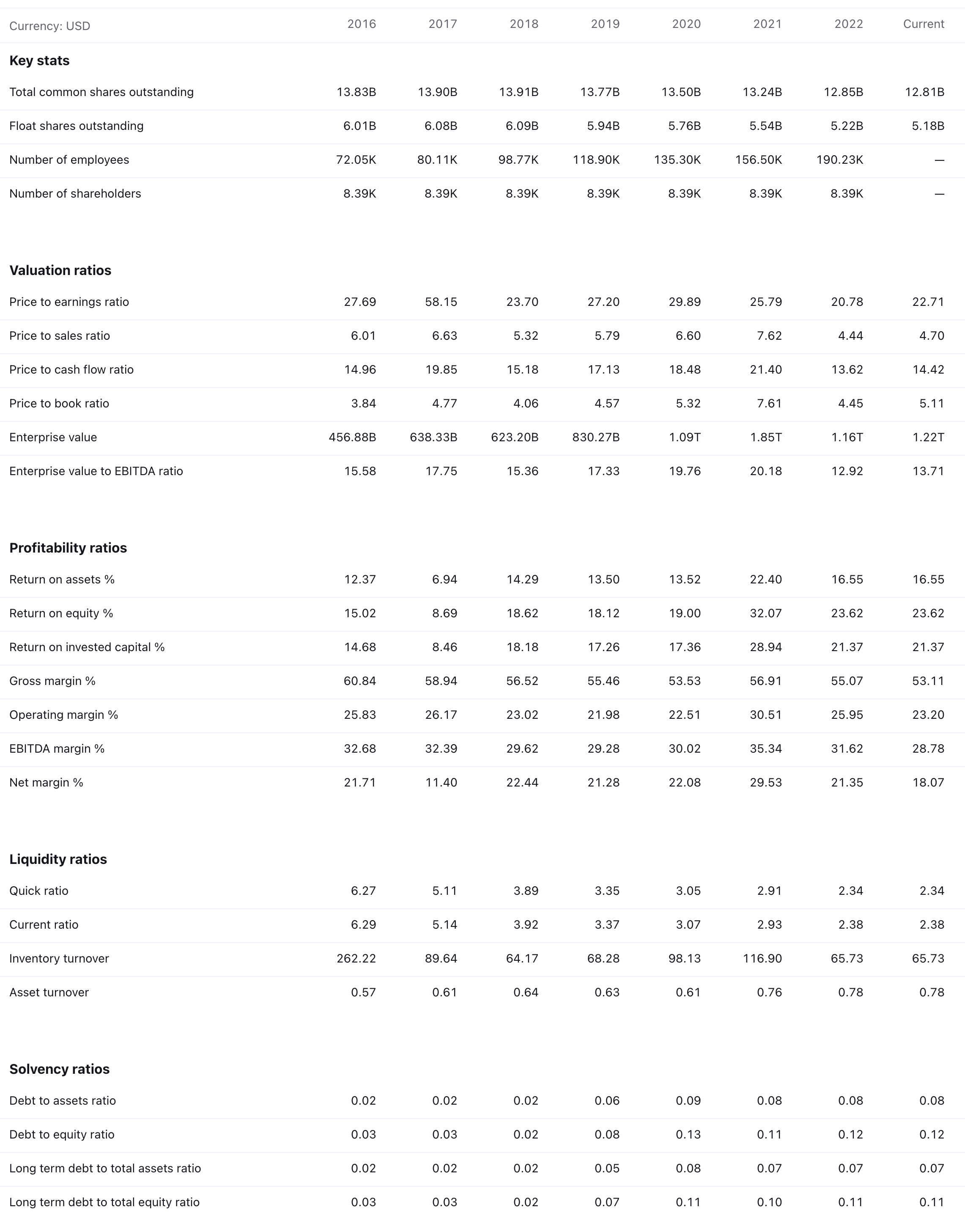

The following data snapshots are as of 04/06/2023 from tradingview website

Key Stats

Performance

Financial Statements

Income Statement

Balance Sheet

Cashflow

Statistics

Sources: Alphabet Investor Relations, Alphabet News, Statista, WallStreetZen, Seeking Alpha, Compounder Fund, Yahoo Finance

Unlock the power of compounding

We are changing the way that people build wealth. If your portfolio is performing below S&P 500 in the last 5 years, then you need to subscribe here. Discover remarkable stories directly to your inbox. As a subscriber, you'll receive the valuable recommendation of an exceptionally outstanding company that are designed to help you build wealth.

Gain access to exclusive benefits by subscribing today!

Disclaimer: Please note that this newsletter is a financial information publisher and not an

investment advisor. Subscribers should not view this newsletter as offering personalized legal or investment

counseling. Investors should consult with their investment advisor and review the prospectus or financial / stock

recommendation of the issuer in question before making any investment decisions. All articles, blogs, comments,

emails, and chatroom contributions - even those including the word "recommendation" - should never be construed as

official business recommendations or advice. Liability of all investment decisions resides with the individual

investor.

Snowball Investing does not provide any guarantees, warranties, or representations, whether explicitly or

implicitly, regarding the accuracy, reliability, completeness, or reasonableness of the information presented. The

opinions, assumptions, and estimates expressed represent the author's viewpoints as of the publication date and are

subject to modification without prior notification. Projections made within the document are based on various market

condition assumptions, and there is no assurance that the anticipated results will be attained. Snowball Investing

disclaims any responsibility for losses incurred due to reliance on this document's content. It is important to note

that Snowball Investing is not offering financial, legal, accounting, tax, or other professional advice, nor is it

assuming a fiduciary role.

Member discussion