The Essentials

We think that the following concepts are important for stock/equity investing. we highly recommend our readers to familiarize and practice them if and when necessary in your investment journey.

Value Investing

Value investing is a long-term investment strategy that, upon thorough analysis, promises the safety of the principal and a satisfactory return. The three elements of value investing are

- One must thoroughly analyze a company, and the soundness of its underlying businesses, before buying its stock

- One must deliberately protect themselves against serious losses under all normal and reasonably likely conditions or variations

- One must aspire to have adequate or satisfactory performance

Margin of Safety

The margin of safety is a concept to help us to protect against serious losses under normal and reasonably likely market conditions. Using a margin of safety, one should buy a stock when it is worth more than its price in the market. This is the central thesis of value investing which espouses the preservation of capital as its first rule of investing. The margin of safety protects the investor from both poor decisions and downturns in the market.

Because intrinsic value is difficult to accurately compute, the margin of safety gives the investor room for investing. Warren Buffett famously analogized the margin of safety to driving across a bridge:

You have to know to enable you to make a very general estimate of the intrinsic value of the underlying business. But you do not cut it close. That is what Ben Graham meant by having a margin of safety. You don’t try to buy businesses worth $83 million for $80 million. You leave yourself an enormous margin. When you build a bridge, you insist it can carry 30,000 pounds, but you only drive 10,000-pound trucks across it. And that same principle works in investing.

A common interpretation of margin of safety is how far below intrinsic value one is paying for a stock. For high-quality issues, value investors typically want to pay 90 cents for a dollar (90% of intrinsic value) while more speculative stocks should be purchased for up to a 50 percent discount to intrinsic value (pay 50 cents for a dollar).

Growth Investing

Growth investing is a strategy that involves buying stocks in companies that are expected to grow at an above-average rate in their earnings or revenues compared to their industry or the broader market. Growth investors are typically willing to pay a premium for these stocks, as they believe the long-term potential for growth justifies the higher valuation.

There are a few key considerations to keep in mind when it comes to growth investing:

Valuation: Growth stocks tend to have higher price-to-earnings ratios, which means they may be more expensive compared to value stocks. It's important to carefully assess whether a company's growth prospects justify its valuation.

Risk: Growth stocks can be more volatile than other types of stocks, as they are often priced for perfection and can be sensitive to any negative news or changes in market conditions.

Patience: Growth investing requires a long-term perspective. It's important to be patient and hold onto your investments for the long haul, as it may take time for a company's growth potential to be realized.

Furthermore, Individual investors have an advantage over professional investors in identifying good investments, as they can bring a unique perspective to their analysis and identify companies that others might have overlooked.

Long-term mindset

One of the hardest things in investing is to control your financial emotions. If you want to succeed in investing then you should buy the right company and most importantly you should be patient and hold on for a very long time. Outstanding businesses take time to become multi-baggers and generate adequate returns. Unless a company has suffered a sea change in prospects, such as impossible labor problems or product obsolescence, or supply chain crisis, a long holding period will keep an investor from acting too human. Being too fearful or greedy can cause investors to sell stocks at the bottom or buy at the peak and destroy portfolio appreciation in the long run.

The bull market succeeds all the bear markets, sometimes it takes several years but ultimately the bull market will triumph. The same principle works for great companies with strong financial fundamentals.

“In the stock market, the most important organ is the stomach. It's not the brain. investors need to know their pain tolerance, and often succeed if they simply hang on to their holdings” - Peter Lynch

If you are investing in the stock market for a few years, you know how hard it is to control your financial emotions. Just think about the stock you bought a few years ago and then sold because of market noise or news or price movements, despite the financial performance of that company being good at that time. If you were holding onto them for a long term, most likely you made greater results now than selling them at this time. The bonus point for the long-term investment is that if you hold on then your dollar value gets to compound without paying capital gain until the end.

Compounding

Compounding is the process of earning a return on investment, and then using that return to generate even more returns in the future. This can occur when an investor earns a return on their initial investment in a company, and then reinvests that return into the same or similar investment, allowing the initial investment to grow over time. The key to successful compounding in investing is finding investments that can consistently generate returns over an extended period of time.

Compounding is the most powerful force in the investing world, and it's available to everyone.. The first rule of compounding is never to interrupt it unnecessarily. The key to making money in stocks is not to get scared out of them.

Long term approach to investing is heavily influenced by the power of compounding which focuses on investing in strong, well-run companies that the investor believes can generate consistent returns over the long term. Holding on to these investments for an extended period of time, it allows the power of compounding to work in one’s favor, as the returns on the initial investment grow and compound over time.It is important to invest in outstanding companies, but it is crucial to be patient and disciplined. The growth in value of an investment over time is the result of compounding returns.

Investors need to understand the importance of patience and discipline in allowing compounding to work, by avoiding buying and selling stocks frequently and instead holding on to them for the long term. Investors should focus on the long-term potential of a company and its ability to generate consistent returns, rather than short-term fluctuations in the stock market. Investors need to understand the market cycles and the role they play in compounding and avoid making investment decisions based on emotions, instead of being rational and objective.

Diversification

Diversification is very important in an investment strategy. Diversifying your portfolio helps to spread out your risk and minimize the impact of any individual investment on your overall portfolio and helps to maximize the returns. It is used to spread out investments across different industries, sectors, and asset classes. It also protects the investments in any macroeconomic factors impacting the stock market and your portfolio. Diversification helps to reduce volatility, which is the amount of risk associated with a particular investment.

Charlie Munger said that “diversification is the only free lunch that an investor can get”, and that “investors should focus on long-term investments, and diversify their portfolios to reduce risk”. and that “it is important to keep an eye on the market, and adjust your portfolio when necessary”. It is important to remain diversified even in times of market uncertainty. Furthermore, he has advised investors to “not become overly reliant on any one asset class”

Diversification across different industries, sectors, and asset classes will minimize the impact of Inflation in the investor's portfolio.

Tax

Tax benefits and maximizing capital gains in long-term investing is a strategy employed by many of the world’s greatest investors. By taking advantage of tax benefits, investors can maximize their investments' returns and capital gains.

Capital gains tax is a type of tax that applies to the profit earned from the sale of an asset. The tax rate applied to capital gains depends on the type of asset and the length of time it was held by the investor. Generally, assets that are held for more than one year are taxed at a lower rate than assets held for less than one year.

The key to maximizing capital gains in the long term is to invest in quality assets that have a high growth potential. Investors should be careful not to get caught up in the hype and invest in assets that are likely to appreciate over the long term.

Though in this newsletter we will only focus on Stock investing, Investors should be mindful of the tax implications of their investments. For example, some investments, such as qualified retirement plans, may be eligible for special tax treatment. Understanding the tax implications of any investment can help investors make better decisions and maximize the potential for capital gains.

By taking advantage of tax benefits and investing in quality assets, investors can increase the potential for greater returns and maximize their capital gains.

Inflation

Inflation has been a major concern for long-term investors, as it has the potential to significantly reduce the purchasing power of their investments over time. Rising inflation can be costly for consumers, stocks, and the economy. Markets tend to be more volatile when inflation is elevated. Inflation can lead to higher interest rates, which can cause market volatility and also make it more difficult for companies to borrow money and can lead to a decrease in profit.

In 10 years, 2.5% (avg) inflation annually would drive the value of a dollar down to $0.78. If the price of a $1,000 Sofa rises by 2.5% over 10 years, it will be $1,280, given the same inflation rate and period. Similarly, the real rate of return on investments should be calculated. Though high numbers make us feel good, inflation eats away at that high number in secret. inflation just takes away investors' wealth. That's why inflation is so easy to overlook and why it's so important to measure investing success not just by what the investor makes, but by how much the investor keeps after inflation.

Stock Investors have the possibility that a loss of the dollar’s purchasing power may be offset by advances in their dividends and the prices of their shares. Historically, in the long run, stocks outperformed inflation. Clearly, As a long-term investor, you'll need to create a portfolio of investments that will provide sufficient returns after factoring in the rate of inflation.

Diversification across different industries, sectors, and asset classes can help to minimize the impact of Inflation in the investor’s portfolio.

S&P 500 vs Picking stocks

An S&P 500 index fund is a type of investment that aims to track the S&P 500 index itself. In other words, it includes the same stocks as the index and mirrors its performance over time.

There are several advantages to investing in S&P 500 index funds. For one, it's a relatively effortless way to grow your savings over time. With compound earnings, the longer investors leave their money invested, the more they will earn. All the investor has to do is invest when possible, then let the fund take care of the rest.

Also, S&P 500 index funds are generally safer during periods of volatility. While the investments will likely take a hit in the short term during downturns, the S&P 500 has a long history of recovering from crashes, bear markets, and recessions. To be clear, it can sometimes take months or even years for the market to recover fully. But by investing in an S&P 500 ETF, the investor’s portfolio is almost guaranteed to rebound eventually. That can be a significant advantage as we face more economic uncertainty.

For most individual investors, the S&P 500 index is the best choice for long-term investments to create wealth since the majority of fund managers failed to beat the S&P 500 index in the long term. Some of them might beat one or two years in a row but failed to bear the S&P 500 index in the long term. As time goes on, the number increasingly drops, and according to the data, only about 10% of actively managed funds have outperformed the S&P 500 over the past 15 years.

If the investor is interested in taking full control over their portfolio and the stocks within it and willing to spend time researching individual companies, and willing to take higher levels of risk for the chance to satisfactory return better than the market then we would recommend the investors to choose outstanding businesses (stocks) to invest in.

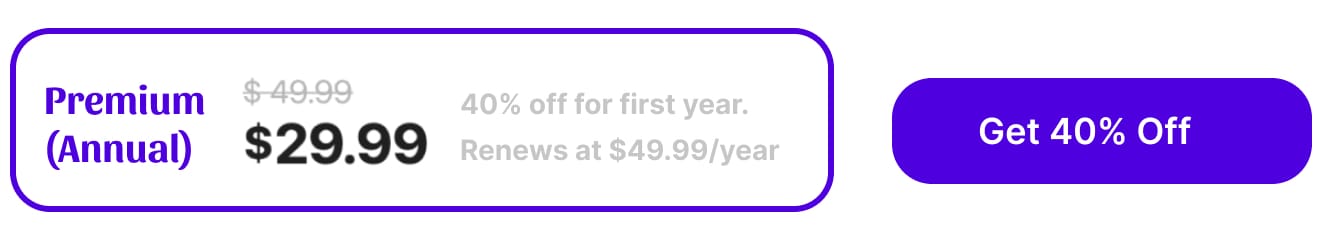

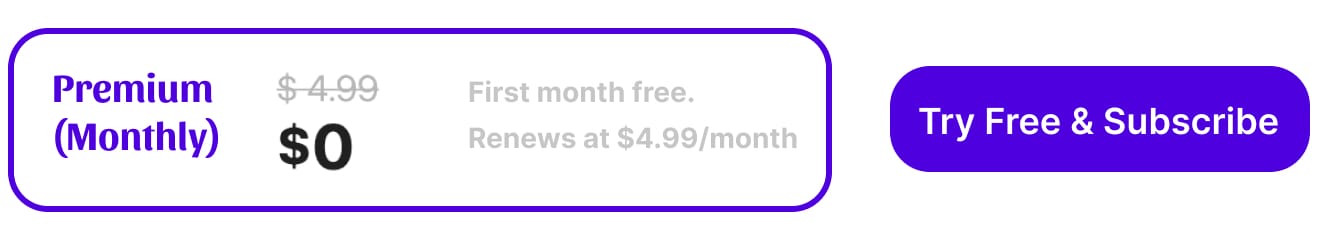

Unlock the power of compounding

We are changing the way that people build wealth. If your portfolio is performing below S&P 500 in the last 5 years, then you need to subscribe here. Discover remarkable stories directly to your inbox. As a subscriber, you'll receive the valuable recommendation of an exceptionally outstanding company that are designed to help you build wealth.

Gain access to exclusive benefits by subscribing today!

Disclaimer: Please note that this newsletter is a financial information publisher and not an

investment advisor. Subscribers should not view this newsletter as offering personalized legal or investment

counseling. Investors should consult with their investment advisor and review the prospectus or financial / stock

recommendation of the issuer in question before making any investment decisions. All articles, blogs, comments,

emails, and chatroom contributions - even those including the word "recommendation" - should never be construed as

official business recommendations or advice. Liability of all investment decisions resides with the individual

investor.

Snowball Investing does not provide any guarantees, warranties, or representations, whether explicitly or

implicitly, regarding the accuracy, reliability, completeness, or reasonableness of the information presented. The

opinions, assumptions, and estimates expressed represent the author's viewpoints as of the publication date and are

subject to modification without prior notification. Projections made within the document are based on various market

condition assumptions, and there is no assurance that the anticipated results will be attained. Snowball Investing

disclaims any responsibility for losses incurred due to reliance on this document's content. It is important to note

that Snowball Investing is not offering financial, legal, accounting, tax, or other professional advice, nor is it

assuming a fiduciary role.

Member discussion